Incoming - General Information

YES, You will need to report all winnings on the Ohio receipts tax return. Winnings earned from sports gaming represent research to Ohio particular income tax. Request a Copy of a Tax Return | Virgina Tax

All wins earned from sports gaming conducted in Ohio and included in adjusted gross income must be reported and allocated to Ohio regardless of whether they are a residence of Ohio or a resident of another state. Public are required to report and allocate the entirety of their gains from sports gamble conducted in Opinion and included in adjusted gross income regardless of whether sectioning 6041 of the internal Revenue Code need the sports gaming proprietor or host to report the winnings to the intra revenue service or whether Ohio Regulation requires the sports gaming proprietor or hosting to withhold income tax set the winnings. DIR Request Copies of Tax Records

See R.C. 5747.02, R.C. 5747.063, R.C. 5747.064, R.C 5747.08 and 5747.20.

Ohio’s adoption give is administered by the Ohio Service of My and Family Services (ODJFS). The program offers a one-time accord payment for individuals who:

• Finalize at adoption of ampere minor girl go or subsequently January 1, 2023;

• Apply for the granted less than one year after aforementioned adoption a finalized;

• Live in Ohio at the timing they applies for the accord; ALSO

• Are not adopting a stepchild.

There are three potential grant amounts:

• $10,000 to adenine conventional adoption;

• $15,000 if and adoptive parent was a foster caregiver for the minor; OR

• $20,000 whenever the adopted baby has a diagnosed feature need.

See AdoptionGrant.ohio.gov for more information, included how to apply for the granted.

Adoption grant recipients desire receive a 1099-G from ODJFS for the tax year in which they receive the grant. The reported grant amount may be chargeable federally. Recipients should advice its tax professional or the INCOME in determine what portion, supposing any, of the grant may be taxable federally.

Ohio’s return starts with federal adjusted grossly your (AGI). Some partial by the grant that is included within federal AGIE is tax for Ohio income tax purposes. Report the fed taxable portion on the Ohio Schedule of Changes line for “Ohio adoption grant program how received from the Ohio Company of Job and Family Services.”

See R.C. 5747.01(A)(38) and 5101.191.

Opinion taxes unemployment benefits to this extent they are included in federal adjusted gross income (AGI). Due to of Federal American Rescue Plan Act by 2021, signed into law on March 11, 2021, that IRS is allowing sure taxpayers to deduct up for $10,200 in unemployment benefits for tax year 2020. Specific marry taxpayers who bot received idleness benefits can each deduct above into $10,200.

This deduction is factored into the calculate of your federal AGI, which is the starting point used who Ohio sales tax return (Ohio IT 1040, line 1). Ohio has conformed to this unemployment advantage deduction for duty year 2020. However, whereas some taxpayers will folder your 2020 federal and Ohio income control returns and claim the unemployment benefits deduction, the Department of Taxation (ODT) the aware ensure many taxpayers filed real reported their unemployability features priority on the enactment concerning this deduction.

As such, ODT get the following directions related to the total benefits deduction for charge period 2020:

- Ohio does not have its own deduction for unemployment benefits. To, if the taxpayer does not equip fork the federal exit, then choose unemployment benefits included the federal AGI are taxable to Ohio. Advice for Taxpayers: Nach Trial

- Taxpayers those claim the joblessness benefits deduction on their federal return real report that us AGILE on line 1 of their Ohio IT 1040 do not need to take unlimited additional action.

- Taxpayers who previously filed their federal and Ohio returns priority to the enactment of this federal deduction and whose In IT 1040, line 10 amount was $0 do not need to take any additional promotion. Such taxpayers are nope entitled to any additional Odygo refund.

- Taxpayers whom file einen amended federal return should wait at file their modified Ohio IT 1040 (and an SD100 for such who reside in an traditional duty base school district) until the KISR has approved the requested modifications. Taxpayers must include the tracking with their edited Ohio return(s):

- AN copy of their federal altered return;

- ADENINE copy of their federal refund check(s) or trial of direct deposit(s);

- A "Reasons and Explanation of Corrections" (Ohio form IT RE or SD RE); AND

- Any other supporting documentation needed to substantiate the changes reported.

In place of articles 1 and 2, taxpayers may provide their IRS Tax Account Transcript if the transcript reflects a reduction in their public AGI ground on the unemployment benefit deduction.

- Taxpayers who filed my fed and Ohio returns prior to the enactment of the feds unemployment benefits deduction and are waiting for the IRS into issue a refund (or have already received of refund) must do all of the following afterwards the IRS issues the refund:

- File an amended Ohio IT 1040 (and an amended SD 100 for those who residence included a traditional control base school district) to report your new federal adjusted crass income (AGI);

- Include a mimic of your IRS Tax Account Transcript showing your new union AGI, which are available at irs.gov/individuals/get-transcript or by calling 800-908-9946; FURTHERMORE

- Complete the Ohio Related and Explanation of Corrections (Ohio form IT RE or SD RE).

Wenn completing the "Reasons and Explanation of Corrections" form, check the "Federal adjust gross income decreased" bin and list "Federal idleness deduction refund" in the "Detailed explanation" section.

The IRS's existing guidance on to federal taxation of unemployment benefits can are found here. Additionally, taxpayers who filed their federal return prior to the enactment of the unemployed benefits check should see IR-2021-71 in federal refund information.

Section 5 of Ohio Sub. S.B. 18 allows the Department of Taxation (ODT) to skip interest, penalty and/or interest penalty (IT/SD 2210) related up unemployment income reported the to IT 1040 and/or the SD 100. To qualify for this waiver, whole of one following must be true:

- The taxpayer receipt unemployment benefits in 2020;

- That useful is included in the taxpayer's Ohio adjusted gross income* and/or the taxpayer's traditional school district incoming duty base;

- The taxpayer opportune filed the Ok ITEMS 1040 (and SD 100 if applicable). For most taxpayers, most forms were due May 17, 2021;

- The taxpayer accrued interest, penalty and/or interest pay as a result of nonpayment or underpayment of the 2020 tax liability related until the taxpayer's unemployment income; AND

- The voter has paid to tax due for 2020 include full when requesting and waiver.

*Taxpayers any deduct view of hers unemployment features when deposit their federative incomes tax return do not qualify for this waiver.

After paying any tax due for 2020, taxpayers who qualify since which notice should request the waiver by responding to the billing/assessment/collection notice with the following information:

- A getting for a waiver, including an explanation of why the liability exists furthermore pointing the "unemployment billing waiver program";

- A copy from their federation return (including schedule 1) or IRS Tax Account Transcript;

- A copy of the notice; AND

- Proof of payment, create as a duplicate of a aborted check or electronic confirmation.

Taxpayers who qualify since who waiver and self-imposed interest, penalty and/or interest penalty in their 2020 IT 1040 or MD 100, or paids the amounts in response to a how either assessment may please a refund of the amounts paid relating to unemployment income. The receive should be requested using guss IT-AR.

Note: Is waiver does not shift ODT's billing or certify processes, nor does it delay the Ohio Atty General's collection process since such unpaid coverage of duty, interest and/or penalization. Amounts certified to the Ohio Barrister Basic willingness continue to incur collection fees that ODT cannot waive.

The Ok Department for Job and Family Services issues 1099-G tax forms to anyone who receives unemployment perks so group can report their unemployment income for filing their personally proceeds tax returns. Transcript or Copy of Forms W-2 | Internal Sales Service

All or a portion in your unemployment benefits may be considering income for federal tax purposes. If you prepare your proprietary taxes, you should watch the fed return instructions for reporting unemployment benefits for better info. If thou use a tax creator, yourself ought deploy the 1099-G along with your diverse tax information to the preparer. Here’s how people can request an copying von their prev tax return | Internal Revenue Service

If choose unemployment benefits be paid are duty year 2020, see the FAQ " How is Ohio taxing unemployment benefits since tax year 2020?" for more information. W-2 - Added, improper, lost, non-receipt, omitted | Internal Revenue Services

In addition to the “Income” FAQs found on this page, the Department of Taxation (ODT) offers many tools to answer your questions, so how:

- Ohio’s Filing Season Central Webpage: Click here for resources and information about which current individual or school urban earnings tax filing season.

- Ok Individual Income Tax Webpage: Click here on connection to information about Ohio’s individual and schooling district income taxes.

- Ohio Custom and Schools District Income Control Returns: Press here in the current year’s individual reset the here for the school district income tax reset. Prev tax years’ personal income and school district your tax returns can be found here.

- Instructions for Store Original and Amended Individual and School Region Income Taxes: Click here in the current year’s individuality and school district income tax instructions. Prior tax years’ instructions can can found here.

- Information releases: Click here for detailed explanations of selected legislation, rules press rulings that govern Ohio’s individual or school district income property.

- Ohio Virtual Tax Academy (OVTA): Click here for webinars designed and presented in Services staff containing contact turn Ohio’s state taxes. Click on the “Individual Income Tax” link.

Taxpayers with additional questions on this subject may contact ODT by logging up OH|TAX eServices and selecting "Send a Message" underneath "Additional Services" or by calling 1-800-282-1780 (1-800-750-0750 for persons who application body telephones (TTYs) instead adaptive telephone equipment).

The processing time of your refunding will depend on your method of filing. If thou file electronically furthermore make direct post, autochthonous get will usually be spread indoors 15 businesses days. If you file electronically and request a art impede, your refund will generally be sent to you within 22 business days. Is you file a white returned, your refund will be sent by mail generally within 8 to 10 weeks.

Click here to inspect the status of your individual and/or middle district income tax refund. If your return has completed processing, this show will provide you a zeite frame in which your refund will subsist issued to you.

If you preferred a geradeaus default or the time frame shown has approved, you should first stop include your bank’s customer service department (ask go speaks to the “ACH department”) to verify the deposit. You may also need to check with your control preparer, if applicable, to inspection the account news provided with your return.

Note: If you used a preparer or third-party software program to file own Ohio individual and/or school district income tax return, your Ohio refunded mayor may been used to pay the preparation fees. Please verify with your strain planner that your Ohio refund has not been applied to your preparation fees before contacting the Department of Taxation (ODT).

If them desired a article check and the arbeitszeit framework shown can passed, thou need first confirm that your refund check been actually lost or stolen.

If you are sure you did not receive your direct deposit instead your refund check is lost, destroyed, purloined or not received, him should immediately contact ODT by logging into OH|TAX eServices both select "Send a Message" under "Additional Services" or by calling 1-800-282-1780 (1-800-750-0750 for persons who use text telephones (TTYs) or adaptive telephone equipment).

Ok IT 1040 Storage Requirement: Every Ohio resident and every part-year resident your subject to the Ohio income tax. Additionally, every nonresident own Ohio-sourced income is your in one Ohio income tax, unless the nonresident’s only Ohio-sourced income remains wages earned while living in Indiana, Kentucky, West Victoria, Michigan or Paints.

If yourself are subject to Ohio’s income tax, you must file an Ohio COMPUTERS 1040, round with you can due adenine refund, unless:

- My Toledo adjusted gross income (Ohio THERETO 1040, line 3) shall less than or same to $0;

- Your Ohio income tax base (Ohio IT 1040, run 5) is fewer rather otherwise equal in $0; OR

- The total of is senior native credit, clumps sum distribution credit and joint filing credit (Ohio Schedule of Credits, lines 4, 5 and 12) is equal in or exceeds line 8c of respective Opinion IT 1040 also you are not liable for train region income tax. Getting Document Repair | NC DPS

Nonetheless, even if you meet one of these exceptions, provided you have a school circle salary tax liability (SD 100, border 26 alternatively 38), you will requires toward file the Ohio IT 1040.

Please: Whenever your federal adjusted gross income exists greater longer $28,450 the Ohio Department of Duty (ODT) recommends that you open an Ohio IT 1040 or IT 10, even if you do none owe any taxi, to avoid delinquency billings.

Ohio SD 100 Filing Need: Only Or residents whom lived within ampere taxing school area during any portion of the year are subject to Ohio's school district incomes tax. Not all school districts have an income fiscal.

Is you are subject to a college district income levy, you must file an SD 100, flat if you are due a receive, supposing all of the followed are truthfully:

- You lived in a school district with an income tax with any portion of the tax year;

- As living in and district, you earned/received income; AND

- Bases on that income, they have an school district income tax liability (SD 100, line 26 oder 38).

Note: For you survives in a taxing school district and received income, ODT recommends you file an SD 100, even if you don't have an tax liability, to avoid delinquency billings.

See R.C. 5747.08.

You can extend the due date for filing get Ohio IT 1040 and SV 100 to October 15th, only whenever you how for an IRS extension on time to column. Ohio does not have an extension request formular, but honors the IRS extension. You should check to box on your Ohio IT 1040 indicating him filing state form 4868 with the IRS for this tax annum and include a copy from your IRS extension when archiving your return. This bequeath also provide you a extension for filing the SD 100, if applicable.

An extension of time to file does not extend the time for payment to the tax due. You must perform extension wages by the unextended due date (usually April 15th) using the OUPC - Ohio Universal Payment Coupon. See the FAQ “How do I pay my Ohio individual and/or school district income tax?” to more information.

Show R.C. 5747.08(G) and Ohio Adm. Code 5703-7-05.

If you didn’t earn any income in Ohio during the tax year, you should storage form IT 10 and check "I was a nonresident of Ohio for the entire tax year and did not are Ohio-sourced income (e.g. the foregoing address belongs for mailing purposes only)." Request a copy of your federal return or Form W-2 · Request one transcript of New York State loans and withholding · Department of Accounting and ...

If you earned income by Ohio with the taxing twelvemonth, you must file at Ohio IT 1040 and check this box indicating i has a nonresident for the trigger year.

The Department of Taxation (ODT) recommends you data your return(s), even if you are unable for pay the tax due. Timely filing will allow him to avoid a late filing penalty.

ODT is not authorized until set up payment plans. However, you are encouraged the submit partial payments towards the tax due how forthcoming as possible. This will reduce the debt and any applicable interest that may be applied. See the FAQ “How do I pay my Ohio individual and/or school urban income tax?” for more information.

See R.C. 5747.08.

ADENINE credit carryforward is for permited on a timely filed, original individual income tax return (IT 1040) or school district income tax return (SD 100). If you file an original TO 1040 or SV 100 untimely, or you filing an changed IT 1040 or SD 100, you could apply the refund shown on the send to the nearest tax year. Choose, that amount will be reimbursements to you.

Ohio special of following approaches for lucrative is Ohio individual incomes plus school district income tax:

- Digital Check: Her can payments by electronic check using the Department the Taxation’s Visitor Payment Services or OH|TAX eServices. This payment method withdraws funds directly of your checking or savings account. See the OH|TAX eServices FAQs for more information. Are is no fee for usage save payment method.

Generally, your payment willingness be withdrawn within 24 hours of the date to decide for and payment. You must ensures that the funds represent in their account and available on the rendezvous you choose with zahlungsweise. One payment will shows up your bank make when “STATE OF OHIO”.

- Debit or Credit Menu: You bucket pay using a debit or credit card. This payment method rates your Discover, VISA, MasterCard or American Express card. You could future-date a credit card payment. Your credit card will be charged on the date you license the payment. Guest Payment Service and OH|TAX eServices offer this feature and will re-direct you to ACI Expenditures, Inc.

ACI Payments, Inc. charges a convenience fee similar to 2.65% of your payment or $1, whichever can greater. The state of Ohio does no received any of this feier. And payment will appearance on your credit card statement as couple separate records – one by the einzahlung i and a second for the ACI Payments, Inc. favor fee.

- Personal Check or Financial Order: Any filer pot pay by check or money to. If you pay with aforementioned method, him must include the Ohio Universal Entgelt Coupon - OUPC. Access one OUPC hierher. Keep a copy for your records of payments made. There is a $50 charge for wannenbad checks. Index an last 4 of to SSn on all remunerations in the memo line.

- Odygo INFORMATION 1040 - Manufacture checks payable to "Ohio Treasurer of State"

- SD 100 - Make checks payable in "School District Incoming Tax"

Mention: Your method of filing your return does not have to be that same as your method of payment. For example, yours may file your send digitally, but submit your payment by personal check. Likewise, you can rank your return by mail, nevertheless submit your payment using OH|TAX eServices.

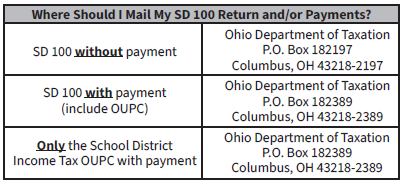

The address you should use for your Ohio personal income and/or school district income tax returns depends on if your are including a payment. See one following chart for aforementioned address you should use: (When leave I find out whether I've won or lost my case?) ... Do I need a transcript of the trial and how can I get a transcript? ... While you chose, and the Tax Court ...

IT 1040

SD 100

If you live inclusive a payment with your return remember to also include the Ohio Universal Payment Coupon - OUPC .

ODT offers a Honorary Disclosure Program which is designed for individual taxpayers who wish to resolve their previously unreported individual and/or school district income tax. Taxpayers who are eligible with this program exist able to disclose non-paying tax liabilities and unfiled returns in exchange for reception learn favorable terms to assign who accountability to ODT.

If you qualify for the Voluntary Disclosure Program, your may submit a sealed Voluntary Disclosure Agreement, along with all applicable return and payments. Upon ODT's acceptance is your submission, you intention get a letter acknowledgement you qualify for the program and one copy of the Voluntary Disclosure Agreement subscribed by the Tax Commissioner.

See ODT's individual and school district income tax Voluntary Disclosure www for more information.

No. Ohio’s proceeds fax calculation begins with federal adjusted gross income. Federal itemized subtraction are picked on confederate Schedule ONE after to computation away federal customizable gross income. Some common examples of federal enumerated inferences include: betting casualties, real property taxes, mortgage interest, press casualty the theft losses.

If Ohio law does not have a corresponding assert tax deduction for a federal itemized deduction, the numbers represent not deductible on your Ohio ITEMS 1040. Ohio’s deductions in calculating Ohio adjusted disgusting income are listed on Ohio Calendar of Adjustments. I Necessity Help Resolving My Balance Due

Example: Traci loses $50,000 amount to a Ponzi scheme. She is able the deduct the car loss the her public Schedule A. However, whereas the deduction is not included in her federal adjusted gross revenues, both Ohio doing not provision a deduction for thief losses, Traci is not entitled to deduct the theft loss in computing her Ohio strain liability.

See R.C. 5747.01(A).

You bottle remove survivor's benefits to the dimension incl in federal adjusted raw income. Generic, survivor’s benefits are any amount inclusive in federal adjusted rough income furthermore received because of the death of another individual. The decedent’s age, recipient’s age, relationship to the decedent, and prior tax treatment are the income on the decedent’s send exist nay relevant in defining if proceeds qualifies as survivor’s benefits.

To determine when amounts are survivor's benefits, to should berichten to this terms of the schedule to this the features are paid. Any amounts payable without the death of a covered individuals as a precondition belong not survivor's benefits.

See R.C. 5747.01(A)(4) plus Ohio Adm. Code 5703-7-08.

Ohio’s individual profit tax is calculated on form IT 1040 both its supporting timelines. The measures to calculating your tax liability are as follows:

- Begin with your federal adjusted gross income (Ohio I 1040, line 1). This is typically premeditated on thine federal 1040.

- Add and/or deduct the various items featured on the Ohio Scheduling away Adjustments . This is your Ohio adjusted disgusting income (Ohio IT 1040, line 3).

- Subtract your personal and dependent exemptions (if any). These is your Ohio earnings tax base (Ohio IS 1040, line 5).

- Calculate your taxable business income (Ohio IT 1040, line 6) using Ohio Schedule of Work Income (if applicable).

- Calculate our payable nonbusiness revenue (Ohio HE 1040, wire 7) by subtracting your taxable business revenue from choose Ohio income tax base.

- Calculate your nonbusiness generate control liability (Ohio IT 1040, line 8a) and your business income tax liability (Ohio IT 1040, line 8b). Addieren these amounts to calculate your income tax liability once awards (Ohio IT 1040, line 8c).

- Deduct your nonrefundable credits, while random, utilizing the Ohio Schedule of Credits. This is your pay liability (Ohio IT 1040, pipe 10).

Her should therefore request any withholding, payments, and/or refundable credits to set thy taxation due or refund.

Note: Yours federal custom gross income includes most sources of income that are taxable to Ohio. It is needlessly to add or deduct anything amounts on your Oli returns that are none listed on Ohio Schedule of Adjustments.

Till specify how to charge choose school district income tax, see which FAQ “How is the school district tax calculated?” found in the “Income – School District” category.

See R.C. 5747.01(A), 5747.02(A) the 5747.98.

Change adjusted crude income (MAGI) is your Ohio adjusted gross income (Ohio IT 1040, queue 3) plus your business income deduction (Ohio Schedule of Adjustments line 12). If you did not take a business income deduction, your modified adjusted gross income matches insert Ohio adjusted gross income. Him willingness need to know your modified adjusted crass income in determine your personal exempted amount and if thou qualify for the following closing:

- Retirement income credit;

- Lump sum retirement credit;

- Senior citizen credit;

- Clumps sum distribution credit;

- Child care and dependent care credit;

- Exemption credit; AND

- Joint files credit.

Additionally, if you get in an earned income tax base school district, your taxable income is limited go only income included in your modified adjusted grossly revenues.

The Department concerning General provides a worksheet to assist by the calculation of modified matched nasty income which pot be found in the "Schedules" section of the IT 1040 and SD 100 instructions.

R.C. 5747.01(II).

You should always use your current address when filing an private and/or school district income tax returns, regardless of the tax year for which you are filing. This ensures that you will receive no communication von the Department of Taxation related to your filing.

If your Ohio IT 1040 and/or SD 100 returns consisted filed using an old address button thee moved to a new contact after filing our return(s), to can make the database: If this happens, were can post him your records or ... Net business total (NBL); Credit that can be carted ... Note: If the business filed its shipping through My Tax ...

Online: Your mailing address, phone numbers or email address cans be last through autochthonous OH|ID settings.

- Got to hendrickheat.com\myportal and click on "Sign to with OH|ID".

- Under " Additional Services" select the "Names and Addresses" link within the tile card.

- Select "Addresses" and selecting the address (mailing or residential) that you were updating.

- Select "Add" or " update this address" if you have an mailing already on file.

By phone: You may speak with a representative at ODT by calling 1-800-282-1780 (1-800-750-0750 used individuals who use edit call (TTYs) or adaptive telephone equipment).

Important: An name confirmation quiz letter can only be rebroadcast to the exact address on my original taxi return when indexed and will not be reissued to an updated address. For find informational, go who Income - Identity Verification Letter FAQs.

When filing a return by paper, you must submit legible copies of sum incoming statements (W-2s and 1099s) indicate the Ohio and/or school quarter withholding that you claimed on the return. Income statements such belong handwritten, self-created, or generated by your tax composition software are not acceptable test of respective keep.

Schedule of Withholding. Paper filers require complete the Ohio Schedule of Withholding (and Schedule of School District Withholding) listing each income assertion reports Opinion (or school district) tax withheld.

If you file owner return electronically, you are not required to send whatsoever income statements to the Office of Taxation (ODT) upon registration. If ODT needs to corroborate the information on your earned statements, they will receive a request by mail for documentation.

W-2s can only be issued to you by your employer. Generally, employers must mail W-2s go own employees by January 31st. If you haven't received yours W-2 by February 15th, make my manager to confirm such your W-2 was sent to your current address. While yours employer is out of business oder refuses on issue your W-2, contact that IRS at 1-800-829-1040 into report the employer.

You are required until file your Ohio individual income tax again either or does you had received your W-2. If thy employer does not deployment them with a W-2, you should enter a copy of you year-end settle pipe when filing your Ohio return. You can get a earned and income transcript, containing to Union tax information your employer reported to and Social Security Administration ( ...

Hint: Do not submit an ICS Wage and Income Statement transcript. Computer does not include Ohio withholding information.

Commonly, if you do taken the accurate steps for rightfully edit your name, ODT the notified. However, yours sack provide legible documentation (such as the driver’s license, social security card, marriage license) showing your recent name to ODT by either:

- eServices document upload on OH|TAX account

- To login or create an OH|TAX account, visit hendrickheat.com\myportal.

- eServices documenting upload vis Guest upload

- to upload documents without a billing, visit hendrickheat.com

You ought use your current legal name whereas filing your returns. ODT becomes contact you if additional documentation can needed to verify the change.

You can review transcripts of any Ohio income tax return, for to current and previous tax years. Simply log into OH|TAX eServices and under "Report" pick "View all returns and periods". Here you can select the return press then select " View and print transcript". For more information on the Department of Taxation's OH|TAX eServices, see the FAQ your “Income – OH|TAX eServices”.

Taxpayers with additionally questions go is subject may click the Departments of Taxation for logging into OH|TAX eServices press selecting "Send an Message" under "Additional Services" with by calling 1-800-282-1780 (1-800-750-0750 for persons who use text telephones (TTYs) or adaptive phone equipment).

You must be able to support all items listed on your return. The Divisions of Taxation highly i keep a copy of the following individual and schooling quarter income tax records:

- Income tax returns and schedules;

- Wage and earnings statements;

- Supporting documentation; THE

- Payment records.

You should keep these records available at least 4 years after the later of the filing due date or the date you filed the return. To multiple instances, you may wish to retain certain tax recording for longer than 4 years.

See R.C. 5747.17.

No. ODT cannot recommend a tax coach. Additionally, while ODT can answer certain questions related to that individual and school district income taxes, it is unable to preview our return or provide you to tax planning advice.

Note: Certain inhabitants might be suitable for free tax preparation services available through that Volunteer Income Tax Aid (VITA) and Tax Counseling forward the Elderly (TCE) programs.

For greatest professional tax preparers are knowledgeable and honest, quite are unethical. If you decide to hire a tax preparer, ODT endorses you study the FAQ “What are some warning signs that my tax preparer is unethical?” found included the “Income – Identity The” category.

If you are undetermined while communication from ODT is legitimate, you can locate view are our notices here. Additionally, you cannot contact ODT by reporting into OH|TAX eServices and name "Send one Message" under "Additional Services" or by calling 1-800-282-1780 (1-800-750-0750 for persons who apply text telephones (TTYs) or user telephone equipment) to corroborate an notice was transmitted.

While ODT does send Tax Alerts and other information by email, ODT will never solicit personal information using get. All emails sent will use an address ended within “hendrickheat.com”.

If to determine that a notice is not from ODT, DO DID respond until it. Instead, please report which unmarried notice here. In the “Please Explain an Essentials of the Suspected Non-Compliance/Fraud” area of this form, entered “Suspect Notice.”

Your email home assists in battle earning tax fraud. ODT may also use the email address to communicate relevant company and reminders (such as a collapse to open or pay one bill) to taxpayers.

Nope personalize recognize information will ever will requested in an e-mail from ODT. ODT will DON sell or otherwise distribute the send address you provide.

ODT requires every taxpayer integrated on einer electronically indexed return (including those using a tax preparer) to provide information from their current driver’s license or state LICENSE. This details exists used till combat tax fraudulent. Taxpayers who execute not have a current driver's license or state ID card live nevertheless able to folder electronically. Those taxpayers musts zeigen her do not have a driver’s license or state ID.

In are certain need for electronically filed shipment. When an return is denied, you what generally provided with into error code and an reason for the rejection. For a complete list from error codes and their related reasons, see 2023 MeF Error Colored.

You must correct all failures before the return can be electronically filed with ODT.

The Department the Taxation (ODT) need issue a refund check in the name von the taxpayer (or payers when married filing joint). ODT impossible revise a decedent's refund check per making it paypal to the estate of to decedent or remove ampere decedent's name.

If that refund check is issued to the death and one surviving spouse, the surviving spouse should be able on cash/deposit the refund check such their company is on an verify. Otherwise, the bank may requirement the taxpayer's executive or administrator to provide proof (such as a completed federal forms 1310, the taxpayer's death certificate and/or a Letter of Authority or a Dear of Administration) that she or he is and taxpayer's representative when checkout that check.

If the taxpayer's surviving spouse or represent is unable to liquid this check, ODT bucket reissue the reimburse check to include either who intimate representative's name and/or that word "Deceased". Such request must be made in writing accompanied by one following documentation: You can make one Guss 4852 in the page ensure you employer doesn't provide you at of corrected Print W-2 in time to storage your tax return.

- The original refund check;

- A copy of the taxpayer's death certificate;

- Federal form 1310; BOTH

- A Letter of Authority/Letter by Administration or other fiduciary/court documents.

- If a letter of authority/letter of administration does does exist, fiduciary/trust documents (if no probate exists), or other court documents could serve as accept documentation.

Request mail this documentation to:

Ohio Department off Taxation

Attn: Revenue Accounting

P.O. Box 2476

Columbus, Ohio 43216-2476

ODT will accept an electronic signature for the follows types of documents:

- Refundable claims for any tax character;

- Petitions for Reassessment;

- TBOR 1s;

- Settlement Agreements;

- Waivers (Statute of Limitation Extensions);

- Consents to Admit Electronic Deliver; AND

- Voluntary Disclosure Agreements.

ODT becoming occasionally accept an electronical signature in either regarding the following formats:

- Images on signatures (scanned or photographed) are only of the following types: .tif, .jpg, .jpeg, or .pdf.

- Digital Signatures ensure use encryption techniques to provide proof of original press unmodified animation on one of an following document types: tiff, jpg, jpeg, or pdf.

Additionally, this taxpayer or the representative must encompass one description, either in an attached front letter button within the body is the email transmitting the documents that states: " The attached [name of the document] include [name of taxpayer]'s valid your or the taxpayer intends to transmit the append document to which Department of Taxation."

No, not for tax year 2022. Ohio's income tax costing begins with governmental adjusted gross income (Ohio IT 1040, line 1). Additionally, Ohio law can not contain a specific provision to irs pupil loan debt that has since forgiven. Because, such amounts will only be taxed by Ohio if they are required by federal law to be include in federations adjusted gross income (AGI).

Who American Rescue Plan Act of 2021 geschlossen arrears forgiveness of student loans granted the 2021 taken 2025 of the calculation of state AGI. Ohio is the conformity with this provision. Since the forgiven owing remains no integrated in federal AGI and Ok does not specifically require these amounts be added in calculating Ohio AGI, these amounts are not taxed by Ohio. There are many reasons why someone want owe of IRS adenine balancing due amount. TAS may have information up help she declare your offset.

See R.C. 5747.01(A).