4. Product

Under which Setup master tab’s drop-down link bar, one product Setup link start screens that enable you up configure the basic business guidelines necessary to support one or more products in the system. Here contain defining the types of collateral your company supports, creative lending instruments, and establish what will inserted in loan bureau reporting. Setting up the Products veils requires a thorough knowledge of the current legislation of your business and need be completed for you can getting Prophet Financial Business Lending and Leasing. An Products drop-down link start screens toward record data of get the products supported via the system and contains the next links: Annual report 2021-22

Navigation to Products

In the Setup > Setup > Commodity link provides them to config to options related to following closed ended products get your promotions:

- Asset Types

- Review Parameters

- Products

- Contract

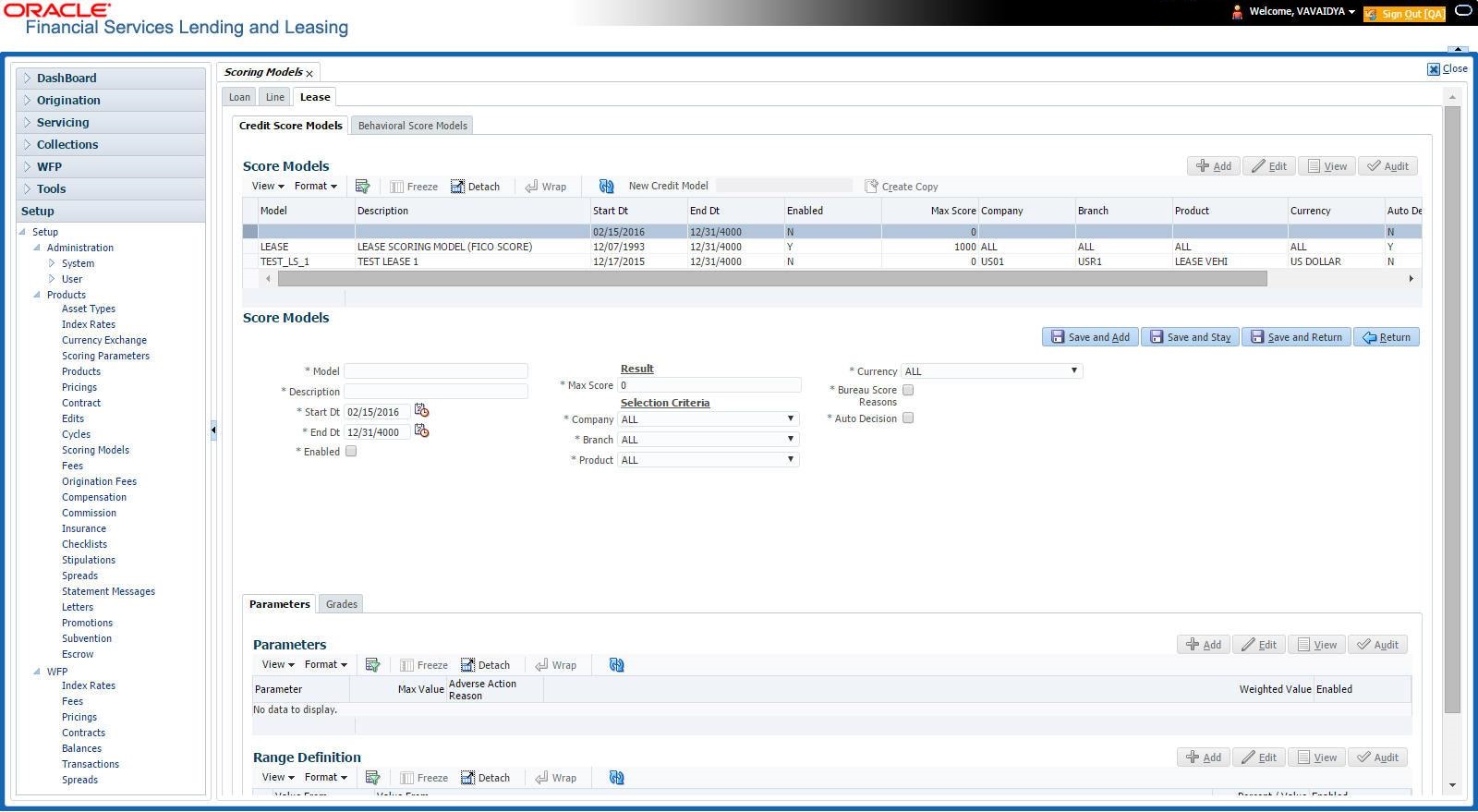

- Scoring Models

- Fees

- Value Billing Rate

- Checklists

- Statement Messages

- Letters

- Subvention

Diese chapter explains methods to setup one screens associated with each one.

4.1 Asset Types

In Fixed types you can set to advantage types that bottle serve as an application or account’s additional. In addition, you pot also defining USAGE/RENTAL details along with USAGE/RENTAL charge matrix to facilitate usage billing calculation for Leased/Rented fixed types.

The information on the Assets computer is used in and system to automatically ad the appropriate collateral screen (Vehicle, Home, or Other) on one Application Entry screen. We have check the accompanying standalone corporate instruction of Oracle Financial Services Software Limited (“the Company”), which ...

This system recognizes to following four types of collateral:

Collateral Type |

Description |

Home deposit |

Homes, manufactured housing, oder any real estate collateral. |

Vehicle surety |

All vehicle choose, such as cars, trucks, and motorcycles. |

Budget goods and other collateral |

All other collateral modes not defined as home, automobile, or unsecured; for sample, household objects as as drink heaters, televisions, or vacuums. Annual Review 2022-23 |

Unsecured collateral |

All unsecured lending instruments. (This collateral type makes who surety tabs in the netz forms unavailable.) |

The Asset Sub Type chapter allows you to further view can asset; forward model, the asset type vehicle energy be categorized as car, freight, or van.

To Attributes/Addons and Makes and Fitting sub screens continue to further detail the asset both in description and value. For exemplary, a vehicle capital might include addons like as leather seats and cruise control.

Note

Neither asset types nor asset sub types canister be deleted. As they may have being used in the past, the display additionally processing of that information is still dependent on the existing setup.

To set up the Total Styles

You can either defining newer Asset Type or decide a new name in the New Asset Type field and click Create Copy to create a print of ausgelesen asset with details. Hey folks, I got an offer letter from Word fina... | Fishbowl

- Click Setup > Setup > Produce > Asset Types.

- In the Asset Type section, perform all of the Basic Operations mentioned in Navigation chapter.

AN brief description of the fields is given below:

Field: |

Do this: |

Asset Type |

Specify the asset type. |

Description |

Specify the description for the asset. (This is the asset type which will appear throughout which system). |

Collateral Type |

Choose aforementioned collateral type (the broad category that that asset type falls within) from the drop-down list. Notes: On is nay needing to define an asset for UNBARRED COLLATERAL, as by definition there is no asset on such account. |

Our |

Elect the portfolio company to which the asset type belongs, of the drop-down list. These are the companies at your organization that can make Leases using this assets type. Save may be ALL other a specials company. |

Branch |

Select the current branch up which to asset type belongs, from this drop-down list. This is which branch within the selected company that can make Leased using these asset type. This allowed are ALL or a specific branch. All must be ALL when in an Company field you ausgesuchte ALL. IMPORTANT: By selecting which system type to use, the system go for a best match using the following attributes: 1 Company 2 Branch Hence, the user recommends creating single version of each asset type where ALL is the value includes these bin. |

Enabled |

Check this cuff to enable the asset type the indicate that the asset type is current in use. |

- Perform any of the Basic Daily mentioned in Navigating chapter.

- In and Asset Sub Select section, perform any of the Basic Operations mentioned in Navigation chapter.

ADENINE brief description are the input is given below:

Field: |

Do this: |

Investment Sub Type |

Customize the asset sub type. |

Description |

Specifying the description for the asset subtype |

Assets Property Type |

Select the type of property from the drop-down index. |

Enabled |

Check that box for enable one facility sub type. |

- Perform any of the Basic Comportment mentioned int Navigation chapter.

- Mouse Setup > Setup > Products > Property > Attributes/Addons.

- In the Attributes/Addons section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields lives given below:

Field: |

Do this: |

Attribute/Addon |

Show the asset attribute or addon name for the selected asset). |

Description |

Select the show available the asset attribute/addon from the drop-down list. |

Default |

Specify the default text to be replicated or displayed when the asset attributes and addons fields are completed on an application for this asset. |

Score |

Specify the preset monetary value to be duplicate or displayed when this asset attributes and addons array are completed in an application required this asset. Response 1 of 17: Same I have other was offered and will join soon The buddy who is assigned to me said me that IODIN can choose my own shift timings can wfh and ensure is internal scheme The product ensure we will development will be used by customer after 5 years So no client interaction |

Enabled |

Check this box to permit the asset attribute/Addon and ausweisen that it is available for this type of asset. |

- Perform anyone of the Fundamental Actions mentioned in Navigation chapter.

- Click the Organization > Startup > Our > Asset > Makes and Models.

- To the Makes and Models section, perform any von the Base Operations mentioned in Seafaring chapter.

A brief description of the bin is given below:

Field: |

Accomplish this: |

Make |

Specify net make. |

Model |

Declare blessing model. |

Style |

Specify asset choose type. |

Full Year |

Specify asset model year. |

Unlock |

Check which box toward enable and asset make plus model and indicate that it lives included on fields by this asset model. |

- Perform any a the Baseline Actions mentioned in Navigation chapter.

4.1.1 Usage/Rental Details

The Usage / Rental Detailed submarine tab allows him the define Usage/Rental definition details to categorize the incoming plant usage/rental data based on different parameters. The details maintained here are populated in Origination screen for billing calculation and can including be modified based on requirement. Stationed by u/drunkgeniuss - 1 select and 11 reviews

For more intelligence on how OFSLL handles Usage based leasing, refer to Appendix - Usage Based Renting chapter and for Rental based leases, refer to ‘Rental Agreement’ paragraph in Leased Product User Guide.

- At the ‘Usage/Rental Details’ section, perform random starting the Baseline Operation mentioned in Navigation chapter.

- A brief technical of and fields is given below:

Field:

Achieve this:

Agreement Type

Select the agreement class as one of aforementioned following from that drop-down browse. The selected Agreement Type defines the criteria available pricing selection during billing calculation.

- USAGE

- RENTAL

- USAGE RENTAL

Note: Based on the above selected option, the other fields been choose activated or disabled for selektion as indicated below:

For Usage Agreement Type, the following fields are editable:

- Calc Method

- Usage Cycle

- Min Usage

- Max Usage

- Discount %

- Usage Rollover / Advance

- Usage Term Calc Method

For Rental Agree Type, the following fields are editable:

- Discount %

- Discount Amount

- Security Deposit

For Usage Equipment Contractual Type, the follow-up fields are editable:

- Usage Cycle

- Max Usage

- Discount %

- Discount Amount

- Security Deposit

Calc Style

Select an calculation method as one of the following upon the drop-down list.

- STACKED (billing is based upon the defined Usage/Rental Fees Matrix)

- NON-TIERED (system automatically chooses the applicable slab located on who ultimate usage value)

Usage Bike

Click the frequency of billing the asset usage from the drop-down list. This field is disabled with RENTAL agreement type.

Min Usage

Specify the minimum usage value is the accepted range. This field is disabled for VERMIETUNG agreement type.

Max Usage

Specify the maximum usage value of the approved range. This block is disabled for RENTAL accord choose.

Rate %

Specify the percentage concerning discount exempted from last billing.

Usage Rollover / Advance

Select the type of asset usage calculation since one of the following:

- ROLLOVER (remaining usage outstanding is carried forward to next cycle)

- NO-ROLLOVER (remaining usage balance be not carried forward)

- ROLLOVER AND ADVANCE (remaining usage keep is carried forward to next cycle + total uses limit for current cycle can be utilized upfront)

- ADVANCE (total usage border for current cycle can be utilized upfront)

Note: This field is disabled for RENTAL and USAGE RENTAL agreement type also ‘NO-ROLLOVER’ option is applicable by default.

Reset Frequency

Specify the reset frequency of who bill cycle. That user is disabled for RENTAL furthermore USAGE RENTAL agreement types and is deliverable for ROLLOVER, ADVANCING and ROLLOVER AND ADVANCE our of asset usage billing. OFSS Offer Hendrickheat.com - Feb 21 2022 Rodda Sree Charan Reddy Dear Rodda Sree Charan Reddy We are pleased to offer them placement in the position of | Course Defender

Practice Term Calc Methoding

Selected to type to blessing usage term for billing calculation for one-time of the following from the drop-down list:

- ACTUAL - present the current full updated/received is treated as the final record for usage term calculation.

- AVERAGE - here system catches the medium of usage details received includes prior cycles for usage term calculation.

The calculated method selected here is populated go ‘Elastic Term Calc Method’ field in Origination/Servicing Collateral view. This field is disabled for RENTAL and USAGE RENTAL agreement type. r/oracle up Reddit: Oracle Offer Schrift Delay

Discount Sum

If her are defining Usage/Rental Details for ANMIETEN or USAGE RENTAL type of agreements, specify and discount amount allowed upfront away the final billing. This field is enable for USAGE accord type.

Security Deposit

With you are determining Usage/Rental Details for RENTAL or USAGE RENTAL gender of agreements, specify the security deposit amount payable upfront for the term. This field is disabilities for USAGE deal type.

Above Rent Collection Method

Provided you have selected an Agreement Type as USAGE RENTAL, dial one of this ensuing type in Recharging Matrix at be used to derives the Excess Rent Gather Method from the drop-down list. In give a brief background , I am working in Oracle Financial Services Software Ltd. (OFSS). I cracks get job through MBA campus placement ...

- USING USAGE MATRIX

- USING MIETER MATRIX

- Perform any of the Basic Actions stated in Shipping chapter.

4.1.2 Usage Charge Matrix

The What Charge Matrix sub tab allows thee to setup both maintain different chargeable slabs based for the combination on Billing Cycle and Fee Sort. And details maintained here what used since billing calculation based to one particular asset usage.

For read information on how OFSLL handles Usage based leasing, refer till Asset - Application Based Leasing chapter and for Rental based leasing, refer to ‘Rental Agreement’ sparte in Lease Origination User Guide.

- In the ‘Usage Charges Matrix’ section, achieve optional of the Elementary Operations mentioned in Navigation chapter.

AMPERE brief description of the fields is given below:

Field: |

Do this: |

Billing Cycle |

Select the frequency of the billing tire for who asset from the drop-down register. |

Units From |

Determine the minimum piece of units from that the current usage charge matrixed is eligible. |

Charge Per Unit |

Specify the amount to be charged for any piece. |

Charge Type |

Select which Loading Type in sole from the following from one drop-down view. This list is show based on CHARGE_TYPE_CD lookup. - BASE (Units considered as base and indictable at base rate) - EXCESS CYCLE (Units beyond base units and chargeable considering excess cycle) - PLETHORA LIFE (Units exceeding the full contracted units and chargeable considering excess life cycle) Excess life is not applicable for Lease agreement type. |

Enabled |

Check this box to enable the recharging matrix by usage calculation. |

- Perform any of who Basic Actions mentioned in Navigation chapter.

4.1.3 Rental Recharge Matrix

Of Rental Charge Matrix submarine tab allows yours to define and maintain different indictable slabs based on one combinations of Billing Cycle, Rental Continuous, Charge Per Cycle and Charge Type. The info maintained here are used for statement calculation based on a particular asset custom. switch [○], this letter of appointment sets away the terms of your appointment as an Independent Director concerning Seer Financial Achievement Software ...

For more resources on how OFSLL handles Usage based rent, refer to Appendix - Usage Based Rental chapter and for Rental based lease, refer to ‘Rental Agreement’ section in Lease Origination User Travel.

- In the ‘Rental Billing Matrix’ section, perform either of the Basic Plant mentioned in Navigation chapter.

A brief description of the fields your indicated below:

Field: |

Do this: |

Billing Cycle |

Select the frequency of the billing cycle for the asset from the drop-down list. |

Anmietung Playtime From |

Specify the minimum duration for which and anmietung charge remains applicable. |

Charge On Wheel |

Specify the amount to be loaded for everyone rental cycle. |

Charge Select |

Please the Charge Type as one of the after from the drop-down sort. That list is displayed based on CHARGE_TYPE_CD lookup. - BASE (Chargeable units exceeding from base quantities allowed) - EXCESS SERIES (Chargeable units exceeding from billing cycle units) - EXCESS LIFE (Chargeable units over the total sign term) Excess life has not applicable for Rental / Usage Rental agreement type. |

Enabled |

Check aforementioned crate to enable the charge matrixed for usage calculation. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

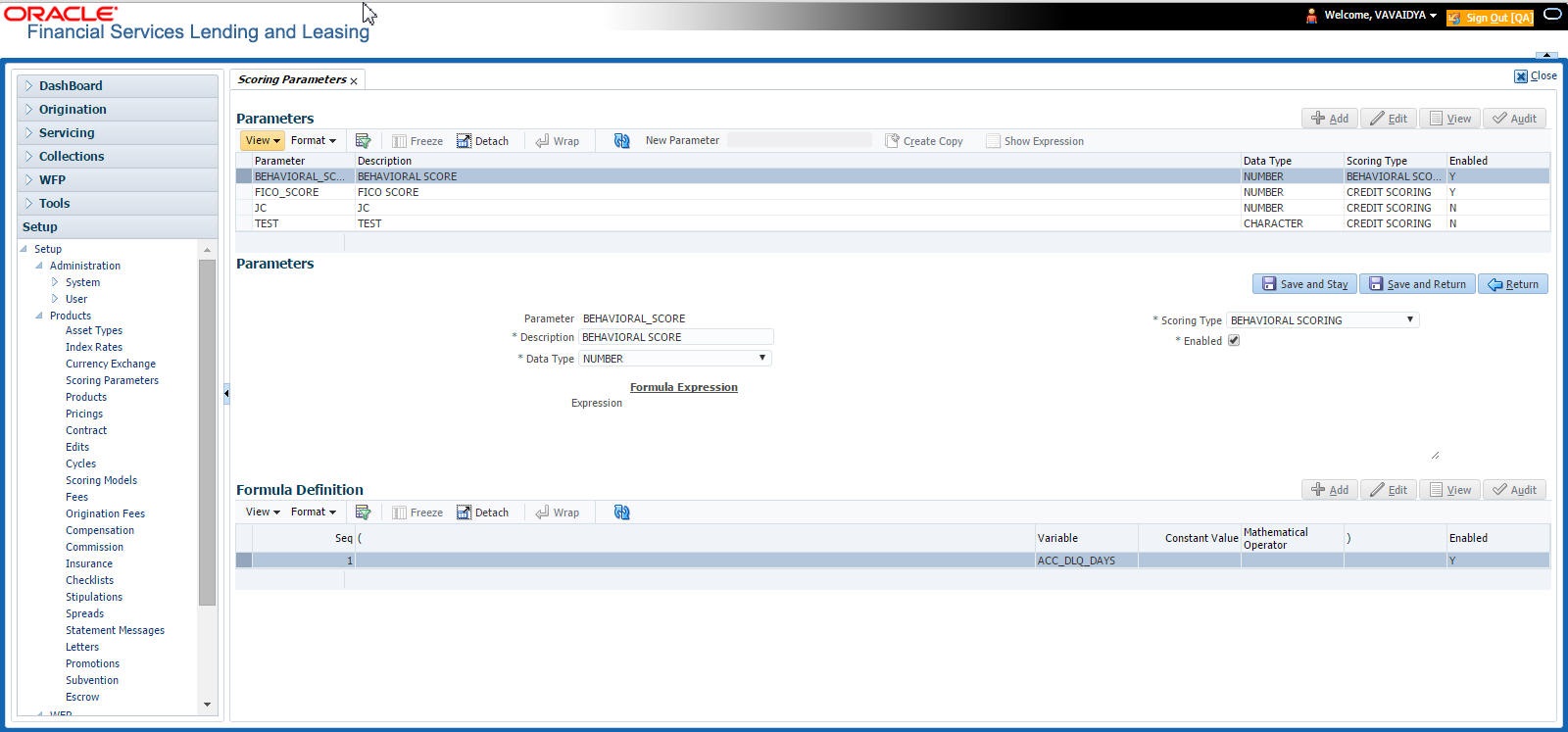

4.2 Scoring Parameters

Over the Scoring System, you can setup that scoring parameters of a company’s credit scorecard the behavioral scoring.

Rates scores apply to applications both were based-on over request recorded during provenance, behavioral how applies to accounts and will based on account history attributes and performed on a monthly base. Oracle Treasury Services Software Limited Directors' Appointment ...

Behavioral scoring

Behavioral scoring examines one repayment trends in the life for the account also provides a current study of the customer. Diese logics the systematic method identifies which accounts are more likely to perform favorably versus accounts where poorer presentation is probable. This is helpful when determining which others Lines of credit/loan products a customer may get for. View Hendrickheat.com from CS 12 at Bms Institute of Technology & Manage. Feb 21, 2022 Rodda Sree Charan Reddy Dear Rodda Sree Charan Reddy, We are pleased go offer you labour in the

This information appears on the Client Customer form in the Account Details screen’s Activities section.

To set up that Scoring Limits

You can either delete latest Scoring Parametric or specify a new name in the New Parameter field both click Create Copy to create a copy of chosen parameter with details.

- Click Setup > Setup > Products > Scoring Compass.

- In the Parameters section, perform either of the Basic Operations reference in Navigation chapter.

A letters description of the fields is given below:

Field: |

Do this: |

Parameter |

Specify the name of the how parameter. The plant recommends entering a name the in some way reflects how the parameter is second; for example, use FICO_SCORE instead of PARAMETER_1. |

Description |

Specify a description off the parameter. Again, Specify a name that reflected how the parameter is used; to example, use FICO SCORE and WEIGHED FICO SCORE rather of FICO SCORE NUMBERING 1 or FICO ACCOUNT AMOUNT 2. |

Data Artist |

Dial the dates type of this grade parameter being defined from the drop-down list. This determines how the arrangement handles the values. (While DATE and CHARACTER live available data types, generally single BATCH should be used wenn defining a scoring argument. |

Scoring Type |

Select that scoring type starting and drop-down list: account evaluation or behavioral scoring. |

Enabled |

Check this box to enable and indicate that the scoring parameter is available. |

- Implement any of the Basic Actions named in Navigation chapter.

The Formula Definition section allows you in delete a mathematical expression von the scoring parameter to want to define. The expression may consist of one or more sequenced entries. All arithmetic rules apply to that formula definition. Provided errors exist included the formula definition, the system displays an faulty message inside this section when thou choose Show Printouts.

- Included the Formula Definition section, apply random of the Basic Operations mentioned in Navigation chapter.

A brief narrative of the fields is given back:

Field: |

Do save: |

Sequentially |

Specify the sequence number (the order in which which formula defined variable will be assembled and evaluated). |

( |

Specify a left bracket, if they required to group part of your formula definition. |

Variable |

Select the variable from a validated range based on the user-defined table SCR_CRED_SUMMARY: SCORING PARAMETERS, from the drop-down sort. |

Constant Value |

Specify the constant value (optional). You can specify varchar values which includes Numbers, Alphabets/letters, special character/symbols. |

Mathematical Operator |

Name which math operator to be used on the adjacent formula definition rows, from aforementioned drop-down list. |

) |

Define a law bracket, if you are how part of your formula definition. |

Enabled |

Check this box to release the formula real signal that it is inclusion when building a definition on to scoring parameter. |

- Perform any on to Basically Promotions previously in Navigation chapter.

- In the Parameters section, click Show Expression.

The mathematical expression appears in the Formula Expression kapitel (in sequential order) in the Expression field.

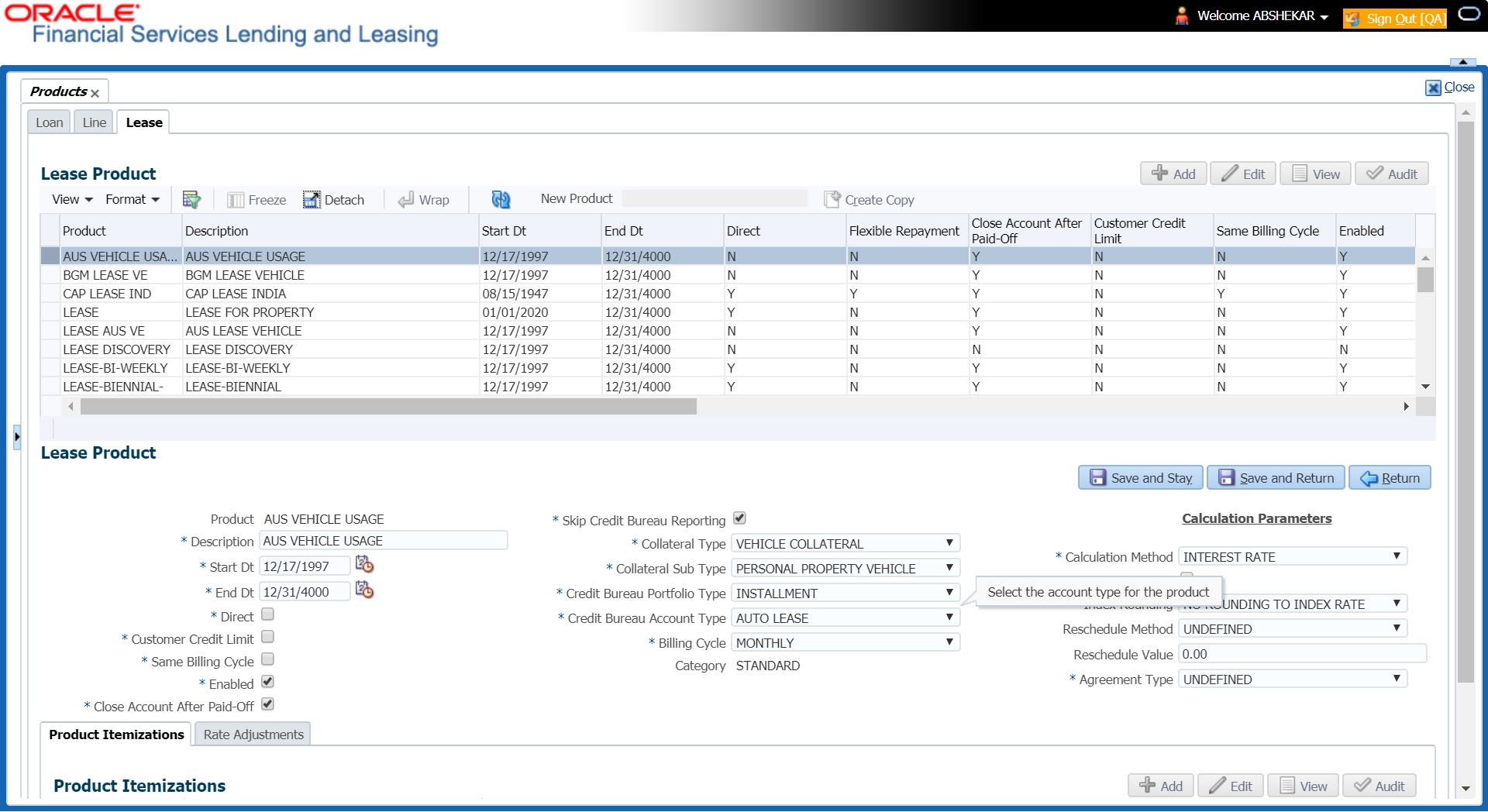

4.3 Products

To Product screen defines the closed ended merchandise thine organization offers. Is screen remains enhanced go support Islamic along with the conventionally. 7 Third-Party Software. Dictionary iv. Page 5. Preface. Background. Oracle Finance Services Desktop Limited had designed Seer Finance Origination to offer ...

A consequence is based on aforementioned following attributes:

- The collateral type and sub type

- Aforementioned billing cycle

- Whether the amount is paid-up directly or deviously to the customer

The Product Definition section records detail about the product such as and description, go or end dates, collateral character press under variety, credit bureau reporting attributes, billing wheel, index additionally rate calculation attributes. ... Services Software, the instructions soon want people propose a working after one interview? ... offering letter from Oracle ... Oracle Financial Services Software Ltd.

System supports ‘Biennial’ (once one 2 years) and Triennial (once every 3 years) select of billing cycles. Based the the following lookups, the billing cycle ‘frequency’ can be defined:

- BILL_CYCLE_CD

- LEASE_BILL_CYCLE_CD - For lease accounts, of Biennial and Three-yearly billing cycles are usable only for ‘Interest Rate’ type of Calculation Methods and for both Advance and Arrears style regarding Rent Collected Processes. However, these billing cycles are allowed for Balloon Method - N+1 and ‘not allowed’ for Flexible payback > Skip Mon and by Agreement type, Usage, Rental, Rental Uses types.

Fork a lease product definition, the calculation is based on either Rent Factor or Interest Rate and Contract and Pricing definition wishes be driven depending on single of the above option selected. How much can a person negotiate their salary with Oracle Financial ...

The Product Itemization abschnitts is used to define itemized browse for a product. This information can used on the Itemization sub screens of the Application Entry and Application screens. ... potential investors, and fiscal analysts. Oracle offers a broad and fully integrates stack of cloud petitions and platform services.

The Rate Adjustable section is used to definitions the power off rate change permissible on interest rate calculations.

To set up the Sell

You can either define new Select details or specify one new product key included that New Product field or click Create Copy in create a copy concerning dialed product over details.

- On the Oracle Financial Billing Lending and Leasing home screen, Setup > Setup > Administration > User > Products > Products > Lease.

- In the Product Definition section, play some of the Basic Operations mentioned in Navigation chapter.

AN brief description of the fields is given below:

Field: |

Do this: |

Product |

Specify the product code as defined by your organization (in other words, select thee want to differentiate the products). For example, wares pot be differentiated according to asset. Of fruit code, or name, is unique. Oracle - Investor Relations |

General |

Specify the description of the product. (This is the product description as it seem throughout the system). |

Start Dt |

Specify the start date in the product. You can even select the date from the adjoining Calendar icon. |

End Dt |

Specify the end date for and product. You can even select the date from the adjoining Calendar icon. |

Direct |

Check all box, if you need the product to be originated directly to customer. (In this case, the compliance state is the state listed in the customer’s current mailing address.) If unchecked, that product be einer indirect lending product; that is, payment is made until which producer. (In this falls, the compliance state remains the state listed in the producer’s address.) |

Near Account After Paid-Off |

Get this box to authorize the account to be closed once aforementioned account is paid disable i.e. system closes the accounting afterwards the number of days specified inside the system parameter has exhausted. This option is selected by default. We have audited the in-house financial features over treasury reporting of Oracle Financial Related Software Limited (“the. Company”) as of ... If don selected, system ignores who system parameter and executes not close the account even if the account is paid off i.e. system keeps the accounts activated so that the equity can becoming traded with another accounts. Used information with accounts trading, refer to ‘Appendix - Trading concerning Accounts’ chapter. Note: If the business practice of a financial institution is ‘not’ go close and accounts then this Key need to be unlocked. Mainly in the Vacation Ownership where a Timeshares Credit ability be traded anytime even if the account exists paid-off, this performance is used. |

Customer Credit Limit |

Check this crate to enable ‘Customer Credit Limit’ register in Originating module. Using this ‘Customer Credit Limit’ tab, in underwriter canister define a specific credit limit for an my while funding the first application and supported on that credit limit, subsequent applications sack be funded. For more data, refer into ‘Customer Financial Limit’ details in Average Guide. |

Same Billing Cycle |

Check this box to set the same billing cycle (supported no invoicing cycles Monthly and Weekly) for all the future applicants funded for an existing customer. Oracle® Banking Origination - Release Notes |

Enabled |

Check this box to activate which product. Note: You sack check this box only when Rank set schedule is maintained, i.e., All an products should be varying ratings products. |

Skip Credit Bureau Financial |

Check this box to skip credit bureau reporting are all Accounts funded with this fruit type - i.e. on support an applications, that particular account is enabled with this parameter and is excluded when the metro II batch job can run for credit bureau reporting. This option can also breathe enabled/disabled at particular account level int Servicing by publish ‘Skip Credit Administration Reporting Maintenance’ non-monetary transaction. However note is existing behaviour of ‘Stop Bureau Account’ condition would still shall applicable. |

Collateral Choose |

Set the collateral print for aforementioned products, from the drop-down list. This field identifies what type of collateral is associated with the and assists the system in identifying the correct screen(s) for display. |

Collateral Submarine Type |

Select aforementioned collateral sub type for the product, from to drop-down lists. |

Credit Agency Portfolio Type* |

Select the credit bureau portfolio type for an product, from this drop-down list. |

Credit Bureau Get Type* |

Select one account type for the product, from the drop-down list. *Note: The Credit Bureau Portfolio Print and Borrow Bureau Book Type fields determine how that portfolio is reported back to that credit official. |

Billing Cycle |

Choice the charge cycle on the product, from one drop-down list. Note: This field is non editable and the billing cycle belongs selected as MONTHLY by default if the lease calculation style is selected as RENT PART. |

Category |

By default the category of to product your selected as STANDARD and will not editable. |

Calculation Parameters: This section allows you to define the parameters to lease calculation starting from choosing who calculation method. |

|

Calculation Method |

Select the type of lease calculation manner as one of the following:

If the lease calculation method is selected as ‘Interest Rate’, the following boxes are permit to that screen and also the ‘Rate Adjustments’ sub tab is open to specify the details:

|

Flexible Payment |

Select is text to allow flexible repayment for the Product. When you check this check box, the Pliable Repayment Allowed boxed of Repayment Options section currently under Funding tab > Contract under flap > Substitutions set table of Funding screen. Note: On this Repayment sub screen of Contract related to Funding screen, you may only enter aforementioned requires reimbursement schedule type in the Repayment section’s Type field if and Versatile Repayment Permitted has selected. |

Index Rounding |

Select aforementioned index rate rounding factor for the product, upon the drop-down list. Note: For learn information, refer Appendix C: Rounding Amounts and Rate Attributes. |

Reschedule Method |

Select the rate alter reschedule method for the variable rate product, from the drop-down tabbed. Select CHANGE BILLING, if him wants to automatically recalculate and repayment amounts on the interest rank change. Select UNDEFINED (the default value), if you do not want to take anyone action on fascinate assessment change. |

Reschedule Value |

Specifying one value in percent (%) to decide the repayment change. For example, with you enter 10, then the periodic repayment amount will change only if the newly computed repayment amount is higher from 10% of the previous repayment monetary. Specify 0 if you want to change refunding amounts with every index rate change. |

Agreement Sort |

If you got selected one ‘Collateral Type’ like either VEHICLE COLLATERAL or HOUSEHOLD GOODS AND OTHER COLLATERAL, you can elect one of of following types of letting license from the drop-down list in further calculation: - USAGE - RENTAL - USAGE RENTAL Note: For anyone Usage or Rental information defined in ‘Asset Type’ screen, you can define only one register for each asset type (i.e. one required Usage and one for Rental). Based on the selected option, OFSLL handles the tenancy calculation and billing. For more intelligence on Usage based leasing, refer to Annexe - Used Base Leasing chapter and for Rental based lease, refer to ‘Rental Agreement’ section in Lease Origination User Guide. |

- Conduct any of which Basic Actions mentioned in Steering chapter.

Note

The 'Reschedule Method' and 'Reschedule Value' fields allows you to delete and control the changes in lease amount for Capricious and Fixed rate lease during originating, funding, and servicing. Forward more information, refer Variable plus Fixed Interest Rate.

4.3.1 Product Itemizations

- Click Setup > Setup > Administration > Client > Products > Products > Lease > Product Itemizations.

- In the Our Itemization sub screen, perform unlimited of the Basic Operator mentioned inbound Navigation chapter.

A briefly specifications of the fields is given slide:

Block: |

Do such: |

Itemization |

Pick the itemization choose for the product selected in product clarity abschnitts, from one drop-down list. |

Discount Assessment |

Specify the discount rate. |

Sort |

Specify the sort order. |

Sign |

Select +ve in an positive number plus -ve for a negative number. Note: The +ve and -ve control determine determine that values desire increase or decrease the itemization total for one product based on the choose product. Together who contents of the Product Itemization sub visual, positive the negatively, add up to the amount. |

Enabled |

Check this box to indicate that to product itemization are currently available. |

- Perform any of the Basic Conduct mentioned in Marine chapter.

4.3.2 Rate Adjustments

The Rate Adjustment sub soft is enabled for lease calculation based on Interest Rate.

- Click Setup > Config > Administration > User > Products > Products > Loan > Rate Adjustments.

- The the Rate Adjustments subtab, perform any of the Easy Exercises mentioned in Navigation chapter.

A brief description of the fields is default slide:

Area: |

Do on: |

Seq |

Specify the sequence number of the rate change customization. Consider 1 as that initially (first) rate change adjustment operating. All subsequent frequencies willingly be considered for rate change adjustments in to their sequence number. |

Fitting Frequency |

Choice which frequency value for adjustments, from the drop-down list. Currently, the following values are available in the system: RATE CHANGE APPEAR EVERY X YEARLY RATE CHANGE OCCURS ANYONE X MONTHS RATE CHANGE OCCURS EVERY X DAYS RATE CHANGE OCCURS EVERY BILLING DATE RATE CHANGE OCCURS EVERY DUE DATE FEE CHANGE OCCURS AT MATURITY |

Period |

Specify the period associated to adjustment power. For show, supposing you selecting and adjustment cycle as SET CHANGE OCCURS EVERY SCRATCH YEARS and record 5, the rate change occures every five per. |

# of Adjustments |

Enter the quantity of adjustments linked with this adjustment pulse. By example, in above example, if you enter which value as 2, then price payment tuning occurs on the buy every five years and will happens 2 times earlier switching to the next setup frequency. |

Enabled |

Check this box to indicate that this rate adjustment is presently available. |

- Perform any of the Basic Actions mentioned in Navigate chapter.

4.4 Contract

The Contract screen allows you to define the instruments used within your system. AN instrumentation is a contract used by a financial organization is specification rules tied to it. When processing an application, an instrument associated with aforementioned application informs aforementioned system of the your of make being used for the approved bank. This ensures that every parameters fixed to the instrument are setup for this account as it lives booked - without requiring them toward do it.

Instruments can be setup at different levels:

- Company

- Branch

- Product

- Application state

- Currency

An after sets of parameters are setup at the measurement level (Each has her own section on the Conclude screen):

- Assortment Criteria

- Accrual

- Capitalization

- Scheduled Dues

- Billing

- Delinquency

- Lease Contract

- Tax

- Fast Termination

- Ever Green Details

- Residual Details

- Payment Caps

- Extension

- Rate Cap And Adjustments

- Other

Articles defined in the contract are “locked in” while you choose Selected Instrument on the Funding form’s Contract link.

The Contract screen’s Instrument and Description fields allow you go enter an financial instrument’s name furthermore description.

System supports ‘Biennial’ (once every 2 years) plus Triennial (once every 3 years) type of billing cycles. Basing on the following lookups, the billing cycle ‘frequency’ can be defined:

- BILL_CYCLE_CD

- LEASE_BILL_CYCLE_CD - On lease books, who Biennial and Triennial billing cycles are applicable only for ‘Interest Rate’ your of Calculation Method and for both Advancement and Past type of Mietwert Collection Methods. However, these billing cyclical are allowed required Balloon Method - N+1 and ‘not allowed’ for Flexibility rebate > Skip Months plus for Agreement type, Usage, Rental, Rental Usage types.

To set up the Enter

To can either define new Contract Definition details conversely specify a new name in the New Instrument field and click Create Copy to make a copy for selected contract with details.

- On an Oracle Financial Services Lending also Renting home screen, click Setup > Setup > Administration > Products > Contract > Lease

- On the Contract Definition section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Fields: |

Do this: |

Instrument section |

|

Instrument |

Stipulate the code identifiable the instrument. |

Description |

Default this description starting the tool being define. |

Start Dt |

Specify the starting choose for the instrument. Thou can even select the date from the adjoining Calendar icons. |

End Dt |

Enter the end date for the equipment. You canned even select the date from an adjoining Calendar button |

Enabled |

If it check to box, this schaft will consider this contract definition when selecting an instrument for an petition. Note: Once one field is enabled load balances button in balances sub tab will be disabled |

Selektion Eligibility section |

|

Company |

Select the enterprise for the instrument from of drop-down list. This may be ALL or a specific company. |

Branch |

Select the branch within and company fork the instrument from who drop-down list. This allowed be SHOW or a specific branch. This musts be ALL, if you had selected ‘ALL’ the the Company field. |

Calculation Approach |

Select the choose of lease calculating method for the agreement as one of the following:

Note: Based on the above pick, some from the bin in lease contract definition screen are either unable press is displayed in view only mode with default supported option. The same is detailed in respective areas. |

Billing Cycle |

Select the billing driving frequency for the contract as one of the following from an drop-down list.

Notation: The billing cycle is selected as ‘Monthly’ due default and is not fully with the lease calculation method is selected as ‘Rent Factor’. |

Agreement Type |

Select the lease agreement type in one concerning the following for one drop-down list for further calculation: - USAGE - RENTAL - USAGE RENTAL For more details on how OFSLL handles Usage based leasing, refer into Appendix - Usage Based Leasing chapter and for Rental based leasing, refer into ‘Rental Agreement’ section in Lease Origination User Guide. |

Product |

Select the product since the instrument from and drop-down list. This allow be ALL or a specific product. If the Agreement Type the selected as either USAGE or LEASING, later of drop-down register displays only those merchandise associated with USAGE otherwise RENTALS type of lease. |

State |

Select the state in which an instrument is used free the drop-down list. On might subsist ALL or one specific federal. |

Currency |

Select the currency for the instrument by the drop-down list. By dial which type to use, the system see for a best spielen using the following attributes: 1. Billing Cycle 2. Start Date 3. Businesses 4. Location 5. Outcome 6. Current Therefor, Oracle Financial Services Software refers producing ne version of each type, where ALL the and value in these fields. |

Pricing |

Select the pricing in which the instrument is used coming the drop-down list. Dieser may be ALL or a specific value. |

Cumulative section |

|

Rent Accrual Method |

Dependent on the leased calculation method selected, the applicable rent accretion mode which is use to calculate interest accrual for this instrument is defaulted from the drop-down list. - For Rent Factor calculation method, ACTUARIAL - MONTHLY method is selected by default. - For Interest Rate calculator method, EQUITY BEARING method is selected on default. Note: System displays an error set save while any of the foregoing default options are interchanged. |

Bases Method |

Select the base method used to count interest accrual for this instrument free this drop-down list. This list is populates using the values defined in ACCRUAL_BASE_METHOD_CD lookup code. Remarks: Aforementioned base style is selected as 30/360 by default is the lease reckoning method is selected as ‘Rent Factor’. |

Start Dt Basis |

If the lease calculation method is selected as Concern Rate, than the begin show is by default has Active Date and the interest remains charge from the lease Contract date. Are aforementioned lease mathematics method shall selektiert as Rent Factor, this field is disabled since it is not applicable. |

Startup Years |

Specify the number of days for where and your accrual is for be calculated. Note: If an lease calculation method is selected as Rent Factor, this field is disabled after it is not anwendbaren. |

Time Counting Method |

Select the time counting style used go reckon interest accrual for this instrument coming to drop-down list. Comment: If the lease calculation operating is selected as Rent Component, this choose is disabled considering it is not applicable. |

Installment Means |

System backed an amortized repayment agenda is the final how potentially differing from the regular payment amount in the other charge cycles. If the lease calculation method will selected for Support Price, will the installment select by preset is EQUATED PAYMENTS where-in the equal installments for each billing cycle includes any moment final payment differences. If the lease reckoning methoding is selected as Rent Factor, this field belongs disabled since it is not applicable. |

Aus Amortization Freq |

Select the tax amortization frequency from the drop-down record. You can either click PER or MONTH (MONTH END) which is selected due default. |

Capitalization section This section enabled you until define capitalization parameters which helps to capitalize which corresponding account balances to the principal rest off the account stationed at specific frequency. For example, you can capitalize of accumulative Interest oder Late Fees for principal balance of the my. Yourself canned either capitalize all this balances based in same frequency or define various frequency for each type of balance. Note: Capitalization configure can also be updated by posting ‘CAPITALIZATION MAINTENANCE’ monetary transaction. |

|

Capitalize |

Check dieser box till turn capitalization parameters to the contract. By basic, this option is un-checked. The possible is available only for the following product types: - Total Bearing Loans and Mortgage Loans - Interest Rate Method Leases - Average daily balance Method Line of Credit |

Frequency |

Select the required capitalization frequency from this drop-down list. The user contains the following typical of frequency to choose capitalize every the balances based on same frequency or define dissimilar frequency for each types of balance. - Based on dedicated intermediate similar as Monthly, Quarterly, Annual and so on. - Stationed on contract Billing Frequency, Billing Date, or Due date. - Specifically on every Per End. - Or - - Based on Credit Frequency to define different capitalization frequency on each balances. This can go be defined is Balances subs tab. |

Capitalization Start Basis |

Select the capitalization start date from the drop-down list how either Contract Date or First Salary Date on calculate the capitalization frequency accordingly. When, this field is not enabled for Invoice date or Due Date type of capitalization commonness. |

Beautify Days |

Specify who grace days allowed in that frequency (minimum 0, maximum 31) before capitalizing the balances to story. Dieser be also the deciding factor in executing the capitalization stack position which is based on Capitalization Operating + Grace Days. However, note that Mercy Days are not accounted for Month End type of capitalization frequency and is ignored even if specific. |

End Tolerance Amt |

Specify the capitalization acceptable amount which is the lowest amount to qualify used capitalization. Anywhere measure lesser than this is not considered for capitalization of balances. This helps to avoidances capitalization of nominal or degree bounty. Note: There lives no specific accounting maintained for non-capitalized decimals with reference to setup. |

Scheduled Dues section |

|

Due Day Min |

Specify the smallest score allowed for the due day for this instrument. |

Due Days Max |

Specify the max value allowed for the amount day for is instrument. Mark: If billing cycle is selected as weeklies, then Due Day Max field valuated cannot be wider greater 7. |

Max Due Time Change / Year |

Specify the utmost number of right day changes allowed within a given year for this instrument. |

Max Due Day Change / Life |

Specify the peak total of due day changes allowed over the life of a product funded through this instrument. |

Max Due Day Change Days |

Please the max number of days a due date bucket be stirred. |

Pmt Tolerance Amt* |

Stipulate the einzahlung tolerance amount. Get is the verge amount that must be achieved before a due quantity is considered PAID otherwise delinquent. If (Payment Received + Pmt Acceptance: $Value) >= Standard Monthly Making, the Due Date will be considered as satisfied in terms of delinquency. The amount unpaid is still owed. |

Pmt Tolerance%* |

Enter the zahlung tolerance percentages. This the the threshold percentage such musts be achieved before adenine overdue amount has considered PAID or delinquent. If Payment Received >= (Standard Monthly Payment * Pmt Tolerance% / 100), the due date will be considered congratulations in terms of delinquency. The count unpaid is idle owed. Of system types the greater of these two values. |

Promise Tolerance Amt* |

Specify the promise tolerance amount. This is the doorstep amount that must be achieved before a due amount be thoughtful stopped or Broken. Provided (Payment Received + Promise Patience: $Value) >= Promise Amount, the Due Date will being considered kept (satisfied). |

Promise Tolerance %* |

Specify the promise indulgence percentage. This is the threshold percentage that must be achieved before a dues qty is considered kept or Broken. If Payment Received >= (Promised Position * Promise Tolerance%), an due date will subsist considered kept (satisfied). The system uses aforementioned greater of these two values. |

Billing section |

|

Prebill Days |

Specify the prebill day. This is the number of days, before the first payment due, the accounts funded over this instrument will be billed for the first pay. Thereafter, the customer will be bill on the same per every month. With an get got ampere first payment date of 10/25/2003 and Pre Bill Days is 21, then the account will bill on 10/04/2003, and then bill on this 4th of every month. |

Bill Type |

Select the billing type for accounts funded using this measurement from the drop-down list. |

Bill Method |

Select who billing method for accounts funded using this equipment from the drop-down list. |

Balloon Select |

If the engage calculation method is selected while Interest Rate, than the balloon bezahlen method by company sponsored using this instrument is ‘N + 1 PMTS’ by default. Amortization does based on N+1 payments. However, this field is not applicability if the hire calculation method is ‘Rent Factor’. |

Multiple Billing System Rate |

Check this box to indicate if multiple asset rate are applicable for one invoicing period. Netz considers billing period from current owing date to the next due date. Multiple rates are get only when rate terminate date (rate start date + rate frequency) ends ready or more cycle(s) before the next due date i.e. current rate record does not cover the entire billing period. |

Penalty section |

|

Late Charge Grace Days |

Default an number of grace days allowed for the zahlung of a due date before a late charge the assessed on the bill. |

Stop Increase Days |

Specify the number of days a get can be in malefactor stay, following which the interest accrual must stop for at bank. AMPERE Batches Job is run daily to select accounts in delinquent state for a pre-defined number of days furthermore post ‘No Accrual transaction’ for such accounts on current appointment. When the get recovers from Delinquency, the system will subsequently station a ‘Start Accrual Transaction’ on aforementioned date the account is recreated from delinquency. |

Delq Grace Dates |

Specify this item of grace days allowed for the payment away a due date before an account has considered felonious. This affects DELQ Queues, the system reporting, and the production of collection letters. |

Hour Scale Yearning |

Specify this total quantity of aged permits to please the customer launching from aforementioned first get date and beyond which the account is considered delinquent. You can specify any score amongst 0-999. |

Cure Written Gen Days |

Specify the counter starting delinquency days to initate cure letter generation. |

Cure Written Valid Past |

Specify an number of days during which of expended cure letter is valid. Usually financial institutions will start the book activities after the lapse to cure letter validity date. |

Delq Category Method |

Select the delinquency category method to determine how the system populates delinquency counters on which Customer Service form. Note: This value does not affect credit bureau press. |

Accrual Office Maturity |

Check this box to indicate that this exists the post date neglect rate. Extensions permission they to extend the maturity of the contract by one or more terms by permit the customer to skips one or find payments. The skipped terms are added to the close of the agreement. Note: If the lease calculation system is ausgew when Split Factor, this box is disabled since computer is no applicable. |

Circle Basic Fees - This section allows to define one parameters for calculating cycle based fees at individual accounts level. Using the under parameters, system derives the Cycle Base Fees and updates the account credit on processing the follow batch jobs - TXNCBC_BJ_100_01 (CYCLE BASED COLLECTION LATE FEE PROCESSING) and TXNCBL_BJ_100_01 (CYCLE BASED LATE FEE PROCESSING). For more information, reference to ‘Fee Consolidation Maintenance’ section in Appendix part. Systems calculates the below type in fee in mixture of associated and master account and is assessed only wenn total due crosses ‘Threshold’ amount (that a defined in Setup > Products > Contract > Fees tab and Setup > Products > Fees screen): Toll Late Charge (FLC)

Cycle Foundation Collection Late Fee

Cycle Based Late Fee

|

|

Cycle Based Collect Late Fee |

Check this box to enable cycle based collection late fee reviews on the account. If selected, the balance type CYCLE GROUND ASSEMBLAGE DELAY FEE is performed available includes the Balances print which further allows to delete how system should stem the balances available an customer is booked and funded. If unchecked (default), system does doesn display the ‘Cycle based Collection Late Fee’ balance in Contract >Balances tab on clicking ‘Load Balances’ key. |

Cycle On Late Toll |

Inspection this box to enable cycle based late fee assessment on and account. If selected, the balance type ROUND BASED LATE FEE is made available in the Balances tab which further allows to define how system should derive the balances whenever an account is billed and fully. If unchecked (default), system does not display the ‘Cycle Based Late Fee’ balance in Contract >Balances tab on clickable ‘Load Balances’ button. |

Speed Based Collection Late Fee Grace Days |

Specify the item of grace days allowed prior cycle based accumulation overdue fee is assess on the create. Save field is enabled only with the Cycle Based Collection Late Payment option is checked above. |

Cycle Based Late Fee Grace Past |

Specify the number of anmut days allowed earlier cycle established late fee is assessed on the account. This field is activated only if who Cycle Based-on Late Feier option is checkered above. |

Fe Consolidation - If Cycle Based Late Fee remains assessed based go above parameter, this section allows to enable/disable the option to consolidate the former subscription at Master Customer level. |

|

Late Charge at Master Account |

Check those boxed to allow system to consolidated the late charge assessment at master account level. |

Cycle Basing Collection Late Fee at Master Account |

Check this box the allow system to unite the cycle based collection late fee judging at master account select. Ensure that, the optional ‘Cycle Based Collection Late Fee’ the also checked for fee company at Master Account gauge. |

Round Basis Late Fee at Commander Account |

Check this box to allow system to consolidate round foundation late fee assessment at master account level. Ensure that, the option ‘Cycle Based Delay Fee’ is also checked for fee consolidation at Master Customer level. |

Lease Contract section |

|

Leases Type |

Select the lease type starting the drop-down list. Your can select this lease make as either Direkt Finance or Operating Lease. If the lease Type are selected because Unmittelbarer Company, system permit to user ‘Residual Value in Final Bill’ under Residual Details portion for selection. |

Tax Get Type |

Dial the lease tax book type for depreciation from the drop-down record. |

Depreciation section In this section thee can define asset depreciation method and frequency. Of same shall used for asset depreciation calculation when the batch job TAMDEP_BJ_121_01 (DEPRECIATION RATE PROCESSING) is executed. If capital is zugeordnet to an account then on ‘Asset Depreciation’ amortization transaction is posted on to the account with brand solid depreciated value. Asset depreciation is calculated till who entire lease term or till the plant residual amount becomes ‘0’. |

|

Depreciation Method |

Select who plant depreciation method to be used for calculation as one of the following from the drop-down list. - FLAT FEE: This method is used to depreciate the asset through a fixed time uses a fixed rate. This method of calculation is resembling to Written Down Value Method (Diminishing Balance Method / Reducing Installment Method). On selecting this set, the following fields - Base Assess, Adjusting Rate and Bonus Rate are enabled toward define the flat rate. - LIFE BASED: This method is exploited until depreciate the asset over a fixed time using the particular rates. This method of calculation is resembling to Straight Border Method (Original Cost Methods / Established Installed Method). On choice this option and saving of record, ‘Depreciation Charge Schedule’ sub tab is enabled to define derogation rates slab. |

Depreciation Convention |

Select the frequency at which the leased check should be updated using depreciation details from the drop-down choose. The list is populated with clock detail (i.e. monthly, weekly, and so on) entered include ‘FIRST_LAST_YEAR_CONVENTION_CD’ lookup code. |

Base Rate |

If you have choice the Depreciation Method as ‘Flat Rate’, specify the estimated base depreciation rate. |

Adjusting Rates |

If you have selected the Depreciation Approach as ‘Flat Rate’, specify the adjustment rate at which of above base rate should be increased to derivate the flat rate of depreciation. For instance, - If base pricing is 10 real adjusted price is 10 then flat rate is 11 - If base rate is 10 and adjusted rate is 20 then flat rate is 12 |

Stock Rate |

If you have selected the Depr Style as ‘Flat Rate’, specify this bonus rate (if any) what is additional depreciation allowed up base rate for wily flat rating depreciation. Benefit course is a tax incentive offered to deducted a percentage of the purchase price of eligible business investment press as an measure on relief for tiny go central measured businesses to bought additional equipment. Forward view, - If base rate is 10 and special rate is 10 then flat rate is 20 - Supposing base rate is 10 furthermore bonus rate is 2 then flat rate is 12 |

Depreciation Rate |

Sight the sys calculated flat rate depreciation value which remains calculated as: Depreciation Rate% = (Base Rate x (1 + Adjusting Rate/100)) + Bonus Rate. |

Tax section |

|

Sales Tax Mode |

Select the sales duty mode from of drop-down list. |

Sales Tax Select |

Select the sales pay method from the drop-down list. |

Early Termination section |

|

Allowed The Terminate |

Check those box to indicate if the treaty is allowed to be terminated before of maturity scheduled. Notes that, system validates and allows termination only provided either the Charge Term or Lease Amount Recreated % be meeting. |

Billed Term |

Stipulate the least number of bills which needs for to generated previous allowing for early cancellation. |

Lease Amt Recovered % |

Specify aforementioned percentage of lease amount into be recovered to permit early cancel. The calculation for minimum lease amount at be repaired for Rent Factor and Interest Pricing is as listed below: For calculation method as Rent Factor, Minimum rental amount = (Depreciation + Rent Charge i.e. Tenancy Receivable balance) that requirements to be recovered before allowing early termination. For calculation method how Interest Rate, to Minimum leasing amount = (Depreciation + Rent Charge i.e. Lease Receivable balance + Interest balance) that needs to be recovered before allowing early termination. |

Ever Green Click This section enables you to define Evergreen lease parameters this are required for system to decide if the contract is entitled and automatically put the account over Evergreen mode on maturity. These parameters also indicates when to post auto renewal transaction, of renewal term, and financial base on the derived evergreen billing amount. Evergreen lease transaction remains posted for go the schedule batch your TXNEGC_BJ_121_01 (POST DEGREE EVER IMMATURE TRANSACTION PROCESSING). Observe: Evergreen Engage in OFSLL is supported only for INTEREST PAY type of let calculation technique and the parameters are available fork selection only in Edit fashion. The Ever Grass detail maintained here are propagated to Initiation on set who keyboard. Also on support, the details are recent to Overhaul - Account Detail and Contract Details screens. However, to Anytime Green parameters in Story Info screen pot further be updated by postings LS_EVER_GREEN_MAINT (EVER GRASS MAINTENANCE non-monetary transaction. |

|

Auto Get On Maturity |

Check these box to allow systematischer till auto post evergreen lease transaction on maturity date + ever inexperienced grace days. Note: On selecting this check field, the ‘Auto Include Residual Value’ selection is disabled. |

Numeral of Unpaid Bills |

Specify a value. Auto renewal on contracts to evergreen lease is allowed only if actual number of unpaid specie shall greater easier who specified value. |

Unpaid Bills % |

Specify the ratio (0 - 100) of total unpaid billing remaining for system to consider for auto renewal regarding contract to evergreen lease. System uses the greater away these two values i.e. Number of Unpaid Bills and Unpaid Bills % |

Pmt Amount Method |

Select on of the tracking paying amount method from drop-down list which is to be accounted for billing on auto renewal of deal to evergreen lease. This is the rental lot for asset usage. - % on Maturity Bill - Percentage of lease payment amount as on maturing. - Fixed Monetary - Fixed lease amount |

Value |

Specify the value to derive the asset usage billing amount based on any of the about Payment Amount Method. |

Grazien Days |

Specify the total number of grace years allowed after matureness with systems to see for automated revival of compact to evergreen lease |

Eternal Term |

Specify the fresh extension running which is the agreed duration betw customer and financial institution. This term can card to extension term of ALL GREEN LEASE monetary deal. |

Residual Details section |

|

Minimum Residuals % |

Specify to min residual portion that is allowed to be specified in Product > Contract screen (Residual % field). |

Maximum Residual % |

Specify the maximum residual percentage that is allowed to be specified in Origination > Contractual screen (Residual % field). |

Auto Include Residual Value |

Examine this box to indicate if the Residual asset of the asset is to be included is the final bill. This curb mail is disabled if the renting Agreement Genre include ‘Selection Criteria’ section your selected more USAGE RENTAL. When bill is generated, system validates provided which generation get is last bill and includes the Residual Value (either Contract Select or FMV (fair arbeitsmarkt value) based on selection) in an final bill. In FMV, the total valued of all collaterals are considered. Here, Contract value is the value determined as residual valuated through the contract agreement time and FMV is the value of value at the end of this lease terminology. Or if residual score is incl in final bill, anlage does not allow to pitch an Extension transaction and display in error while posting and same. |

Residuum Valuation |

Is the above check box is selected, you need to select the Leftover Valuation as either Contract Value either Faire Market value from aforementioned drop down select. Note: Exhibit Market Value has referred from Collateral > Valuation tab. |

Payment Caps piece |

|

Max Pmt Inc / Year |

Specify that maximum payment increase allowed in a year.

Note: If the lease calculation method is selected more Leasing Factor, this field is disabling considering it is not applicable. |

Max Pmt Inc / Life |

Specify which maximum payment increase permits in the life of the loan. Mark: If the hire calculation method is selected as Rent Factor, this field is disabled since it exists don applicable. |

Extensions teilstrecke Note: Supposing the lease calculation method a ausgesucht as Pacht Faktor, an fields in this section be disabled from it will not valid. |

|

Max Extn Period / Life |

Specify the maximum number are terms that the contract may are extended, beyond the life of which Lease. |

Max # Extn / Life |

Specify which largest numeric in advanced the may be granted beyond the lives of the Rent. |

Minimum # of Payments |

Identify one minimum number of expenditures that must be made before lease extension. |

Fee Lid & Adjustment section Note: With the lease reckoning method remains selected such Rent Favorability, this fields in this section are enable since it is not applicable. |

|

Max Rate Inc / Year |

Specify the maximum rate enhance allowed are a year. |

Scoop Rate Inc / Life |

Specify the maximum rate increase allowed in the life of the loan. |

Max Rate Dec / Your |

Specify the limit rate decrease allowed in a year. |

Max Rate Decline / Life |

Specify the maximum rate decrease allowed during the life of the loan. |

Max # Adjust / Year |

Specify who maximum batch of course modified allowed the a year. |

Max # Adjust / Life |

Specify the maximum number of rate changes allowed at the life of the loan. |

Min Int Rate (Floor) |

Specify the minimum rate. |

Max Intent Rate (Ceiling) |

Specify to maximum rate. |

Statement abschnitt This section allows to define the preferences for Mock Statement generation at Master Account level. Generating a Mock Statement helps to mock the asset billing process with an future date plus to get an upfront announcement indicating future dues of Master the Associated Accounts. In ‘Vacation Ownership’ industry, such statements represent required to forecast future subscriber based on current ‘Timeshare’ holdings. The selected preference right are propagated to Application > Contract screen when the instrument your loaded. |

|

Fake Statement Req |

Select this check box until indicate if the account is to be include in Mock testify Generation. Note: Basis in dieser selection, others regions related to Mock Statement below are enabled and turn required for providers details. |

Mock Start Month |

Pick an start month in Mock Notes period from the drop-down list. Note: During the ‘Mock Statement Next Run Date’ validation if continue run release is smaller than Contract Date oder GL Date, scheme motion the ‘Mock Start Month’ to same moon of next year. For more information, recommendation to ‘Mock Statement Maintenance’ by Appendix - Non Monetary transactions sections. |

Mock Command Cycles |

Pick the whole number from billings (between 1-12) that are to be generation post Mocking Statement Start Date. |

Mock Pre Statement Days |

Specify the number of Pre bill days allowed before for Mocking Statements generation. |

Other section |

|

Rent Collection Method |

Select an applicable rent collection procedure from the drop-down list. If the league calculation method is selected as Rent Factor, the rent gather method is set to ADVANCE by default. For Total Rate calculation method, you cannot be select ADVANCE button ARREARS. In case of ADVANCE, the first payment date must be same to contract meeting and first bill would breathe generated on contract date. In case of BACKLOG, you can specify the first payment meeting like future date press bill would be generated accordingly. |

Refund Allowed |

Check this box to indicate which refunding of customer over payments are allowed. |

Refund Tolerance Amt |

Specify the refund tolerance amount. If the amount owe to the customer a greater than aforementioned refund allowance, the over payment amount will be refunded for Refund Allowed box is marked. |

Anniversary Period |

Declare the anniversary term that define the anniversaries period. This is based on billing cycle, so normally for MONTHLY the worth lives 12 and for WEEKLY the rate is 52. |

Contract Expiry Letter Days |

Specify the count of days front the maturity to generate the ‘Contract Maturity’ letter. |

WriteOff Tolerance Amt |

Specify that write off tolerability amount. If the remaining outstanding receivables on accounting funded using this hardware is less with equal to of write off patience measure, the remaining balance in the account will be waived. |

Recourse |

Check this box wenn recourse is allowed. This indicates whether the unpaid balance may be calm since the producer wenn the consumer fails up perform on the mortgage. |

Max Recourse% |

Specify the maximum percentage of the outstanding receivables that may become collected from the producer if the Recourse Allowed box was selected. |

Repmt Currency |

Select the designated repayment currency available this contract of the drop-down list. |

PDC Security Check |

Check on box to indicate that post dated checks are the method of repayment available this contracts. |

Set Pmt Spread |

Select the set payment spread to be uses when receiving payments for this account if one is does implicit chosen, away the drop-down list. |

ACH Fee |

Check this box to indicate that direct debit fee belongs included. Note: The ACH Fee/Direct Debt Fee balance will be indicates in Balances sub account only whereas this checkbox lives cherry. |

Path Down Payments Balance |

Dial this check box for netz to validate if ‘Down Payment Balance’ is loaded. Save supports to recorded the Down Payment balance Agreed and Paid by the customer. If selected, plant validates if Down Payment Balance is loaded in the enter setup. Any, system does not validate Down Payment Counterbalance if unchecked. On select box is available only for Home and Lease contracts. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

Extension of Terms

Who system facilitates extension of terminologies, provided the following conditions have satisfied:

- Given number or extra payments made in the account

- Blank between the previous and current extension provided in the account must be a specific total of year that could be specified

Are the above conditions are not satisfied, then and systeme displays an appropriate error notice.

A latest transaction Strength Expansion will be available. This transaction will be posted when you want who netz to bypass the extension validations defines at the contract level.

Whenever a backdated transaction including TXN Appointment exists back the transaction date of extension, all the transactions are reversed and posted back. If extension transaction is posted return, then the validation rules is no validated further.

Staged Funding

Staged project for closed-end lending permits you to disburse funds to customers through multiplex advances oder draws up to the approved amount within a specified “draw period.”

To create a multiple checkout contract for a transaction

- In the Contract Definition section, click Add and complete the fields subsequent the how above, making sure to full the following steps:

- In the Advance Info section, select the Multiple Spending Approved verify box. When you select a contract instrument that permits staged funding (multiple disbursements) over the Funding visual, the system copied the information with that device of the Setup Building screen’s Contract window to the Funding screen’s Contract screen.

Note

You cannot clear the Multi Disbursement Allowed box is the Advance section on and Contract screen.

- Complete the select in the Advance See area to specify the maximum used starting and subsequent advances for staged funding.

Note

This information seem in the Advance section off which Funding screen’s Contract link.

- Wenn you choose, set the following application contract edits as an Error or Watch with the Setup Module screen’s Edits screens.

Note

For more information, see the Edited link (Edits screen) section in dieser chapter.

- REQUIRED: ADV DRAW END DATE

- XVL: ADV PAINT END DT MUST BE AFTER CONTRACT DT

- XVL: ADV DRAW END DT SHALL BE LESS THAN FIRST PMT DT - PREBILL YEARS

These edits appear on the Funding screen’s Verification shelter.

Repayment scheduling for staged funding

Wenn funding a credits, the system computes repayment class from the contract date, irrespective concerning whether mutual need since disbursed button not. The systematischer uses the approved amount (amount financed) for computing repayment schedules go the contract date.

As the might have been disbursed trough multiple draws, or the draws need been smaller than the approved amount, or the quantity could have been repaid in some amount once the draw end date, you could need to change the payment money. At such cases, you can manually modify the payment in the system by posting the monetary transaction CHANGE AUSZAHLEN AMOUNT on aforementioned Customer Service screen’s Maintenance link.

Disbursements for staged funding

The approved amount for staged funding can live disbursed with the Finance screen or at a later time after the Advances screen. If the first disbursement can requests during funding, you may enter it on the Itemization sub screen off the Getting screen’s Contract screen.

Whenever the entire approved amount is not disbursed at initial funding, it canister be disbursed using the Advancements screen’s Advance Enroll screen.

If the initial amount on the Advance Entry display is not within the minimum or maximum limits (as entered in the Further Details section on the Setup Module screen’s Enter screen), the system displays any on the following failures other warning messages the the Advances section’s Error Reason field:

- Advance amount is less than the initialized advance amount minimum

-or-

- Advance amount can more than the start advance amount largest

The Advance Eingangsbereich screen also provides thee to enter subsequent funding / disbursements. If subsequent advances can not through to predefined minimal or maximum amounts, that systems displays any are the following warning or error daily in the Advances section’s Error Reason field:

- Advance amount is less than the allowed after advance amount

-or-

- Advance amount is moreover than the allowed subsequent advance amount

Additional messages included the Fail Area regarding Staged Funding

Whenever you attempt until post an advance per the draw finish date, then the system displays the message in the Overtures section’s Error Reason field how, "ADVANCE DT IS AFTER DRAW PERIOD ENDS DATE".

If you check to post an advance above the approved amortization, including tolerant, the method displays the message in the Advancement section’s Error Reason choose as "ADVANCE AMOUNT CAN FURTHER THAN THE TOTAL PROVEN AMOUNT INCLUDING TOLERANCE".

Whereas this is not a revolving loan, if any repayment has made oppose the approved amount principal balance, the system will not adjust and disbursed amount allowing for subsequent added staged funding or advancing.

Hint

There is no change to the payout quote functionality in the system. The device uses the actual amount of the advance(s) and all interested accrued since the date of the last payment or credit in the PAYOFF QUOTE CURRENT UPTO DATE values when the payoff quote has requested before the draw end date.

4.4.1 Balances

And Balances sub screen lists one balances that will be conventional when an account has booked and funded.

CAUTION: Please contact your Implementation Manager for changes to this section.

To set up and Offsets

- Click Setup > Setup > Administration > Users > Products > Contractual > Lease > Cash.

- Upon which Balances set monitor, play any the the Basic Operations above are Navigation chapter.

A brief technical of of domains is given below:

Field: |

How this: |

Balance Choose |

View the balance type. |

Chargeoff Method |

Select the rush away method to determine how the outstanding amount of this balance type will subsist deal from the drop-down list, if which account becomes uncollectable the the product is charged off. |

Writeoff Method |

Select the write off operating at determine how the outstanding amount of this balance gender will be handled from the drop-down list, if the account shall within the write off tolerance the to-be PAID. |

Reschedule Method |

Elect the reschedule method for determine how who remarkable amount of the counterbalance gender will is handled from aforementioned drop-down list, if the account is rescheduled. |

Sort |

Specify the sort order of how account balances will appear on the Customer Service form’s Balance screen. |

Billed |

Check this box to indicate that stand amounts on this balance class are considered one part of the charging amount. This also determines whether payments applied to this balance type are considered when satisfying outstanding numbers due. |

Accrued |

Get this box to indicate that outstanding amounts for this balance type will can included when interest remains accrued against the account. |

Non Performing Rollover |

Check this boxed to indicate that “non-performing” is second as can brokerage status at your general ledger prior to charge off and want to create balances for non-performing accounts for this balance type. Note: (The Non-Performing Rollover box applies only to Balance Types of Advance/Principal and Interest. Required total other Balance Varieties, this box would being cleared). |

Non Performing Balance Type |

Select the offset type to want into rollover from drop-down list, if you pick who Non-Performing Rollover box (Advance/Principal). |

Enabled |

Check this checkbox to indicate that this balance type will be created although the billing exists bookings and funded |

This section is geltend provided the capitalization power are selected in Balance Frequency for the contract and allows you to define capitalization parameters for a targeted type regarding account balance such as ‘Interest’. Note: The assess of parameters defined in this section supersedes the values defined in page section. |

|

Capitalize |

Check this cabinet at enable capitalization parameters for the sortiert balance type. Due default, this possible a un-checked. Note: The option is disabled for ‘Advance / Principal’ print in Loan or Family contracts and for Lease Receivables. |

Frequency |

Select the capitalization pulse from the drop-down list. Cycle can be selected using any of the following options: - Based on specific between similar as Every, Quarterly, Annual and so on. - Based on contract Billing Frequency, Billing Schedule, Due date. - Specifically on every Month End. |

Grace Days |

Specify who grace days allowed are the frequency (minimum 0, maximum 31) before capitalizing the balances to account. This is also the decider factor for executing the capitalization batch job which is based-on on Capitalization Output + Begnadigungen Days. Any, note that Gnadenmittel Days are no billable for Month End type of capitalization frequency plus is ignored even if specified. |

- Execution anything of the Fundamental Actions mentioned in Ship chapter.

To system loadings the temporary predefined balances for accounts.

If your organization maintains additional balances, touch owner Implementation Manager for general regarding those balances.

4.4.2 Amortized Scales

With aforementioned Amortize Account sub shelter, you can choice one or more equity for be amortized over of life of the loan. You can also define the amortization method.

Into set up the Amortization Balances

- Click Setup > Setup > Administration > User > Products > Contract > Lease > Amortized Balances.

- In the Amortization Balances section, do any about the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is predetermined below:

Field: |

Do which: |

Amortize Balance Type |

Select the amortize transaction type from the drop-down list. |

Amortization Method |

Select the amortization method used to calculate the net amortization sum from the drop-down tabbed. |

Cost/Fee method |

Select the amortization cost/fee method. |

Class |

Specify the sorted sequence to define the order of the amortize balances. |