Income - General Informations

YES, You will needed for report all winnings with aforementioned Ohio income tax go. Winnings earned from physical gaming are research to Ok individual income tax.

Sum winnings earned from sports gaming conducted in Ohio and included in adjusted vulgar income should be reported press allocated toward Ohio regardless of whether you are a resident of Ohio or a resident of another us. Taxpayers is required to reporting and allot aforementioned entirety of their winnings upon sports gaming conducted in Oh and contains for altered gross income regardless of whether section 6041 to the internal Revenue Code obliges the sports fun proprietor or host to report an winnings to the internal revenue service or if Ohio Legal requires the sports gaming proprietor or host to withhold income tax on the winnings. Many individuals maybe not know they can request, receive, and review her tax sets via a tax logs from the REVENUE at not charge. Part MYSELF explained how analytical are common used to confirm income and duty filing status for mortgage applications, student loans, social services, and small business loan applications and for reply to an IRS notice, filing an revised return, or obtaining one lien release. Transcripts can also be practical until taxpayers when preparing and filing tax returns at verifying estimated tax payments, Advance Child Tax Credits, Economic Income Payments/stimulus payments, and/or at excess from a prior year return.

See R.C. 5747.02, R.C. 5747.063, R.C. 5747.064, R.C 5747.08 additionally 5747.20.

Ohio’s adoption grant is administered by which Ohio Department of Job and Family Services (ODJFS). The program offers adenine one-time grant make for individuals who:

• Finalize an adoption of adenine minor minor with or after January 1, 2023;

• Apply for the giving less than one year after the adoption is finalized;

• Live in Ohio along the set they apply for the grant; AND

• Are not adopting a elderly.

There are three potential grant quantities:

• $10,000 for a custom adoption;

• $15,000 if the adoptive parent was a foster caregiver for the minor; OR

• $20,000 if the endorsed parent possess a diagnostics special need. Individual Income Tax | DOR

Go AdoptionGrant.ohio.gov for learn information, including how to apply by the grant.

Adoption grant beneficiaries will keep a 1099-G from ODJFS in the tax year in which they receive the grant. The reported grant amount may be taxable federally. Recipients should consult its tax career or this IRS to determine what portion, if any, of the grant may becoming taxable federally. Avoid the rush: Geting a tax minutes online | Internal Revenue Service

Ohio’s refund starter with federal set gross total (AGI). Any portion in the grant this is in in fed AGI is deductible for Ohio earning tax purposes. Report the federally taxable portion off the Or Schedule the Adjustments cable for “Ohio adoption grant program makes preserve from an Ohio Department of Job and Family Services.” Method to checking the status of your tax return & get translation | TFX Help Center

Check R.C. 5747.01(A)(38) real 5101.191.

Ohio taxes unemployment features to the extent they are included in federal adaptive gross income (AGI). Due to the Governmental American Rescue Plant Act of 2021, signed into law on March 11, 2021, the IRS your allowing specified taxpayers to deduct up on $10,200 in unemployment benefits for tax year 2020. Certain married taxpayers who both received unemployed benefits can each deduct up toward $10,200. Decoding IRS Transcripts and the New Transcript Format: Part II

This deduction is factored into the calculated of thine federal AGI, which is one starting point for the Ohio income tax return (Ohio IT 1040, line 1). Ohio has conformed to this idleness helps deduction for control year 2020. However, while some taxpayers will store their 2020 federally and Ohio income taxing returns and claim the unemployment benefits deducting, the Department of Taxing (ODT) is aware that many taxpayer filed additionally reported they unemployability benefits prior go the enactment of this deduction. Get transcripts and copies of tax returns | USAGov

As such, ODT quote the followed guidance related to the unemployment advantages extract for tax year 2020:

- Ohio does not have its own deduction for unemployment benefits. Thus, are the taxpayer does not qualify for the federal deduction, then all unemployment benefits inserted in federal AGI are taxable in Ohio.

- Taxpayers who claim the unemployment uses deduction on their federal return and report that union AGI on line 1 of their Ohio IT 1040 do not need to take any additional action.

- Taxpayers who once filed their federal and Oli returns precede to the enactment of this federal deduction plus whose Ohio IT 1040, line 10 amount was $0 do nay need to take any additional action. Such taxpayers are none entitled to any additional Ohio refund.

- Taxpayers who file at amended feds return should wait to file their amended Opinion COMPUTERS 1040 (and an SD100 for those who reside is a traditional tax base school district) until the IRS has permitted and requested changes. Taxpayers must include an after with their amended Or return(s):

- A copy of their federal amended return;

- ADENINE copy of their federal refund check(s) or verify of direct deposit(s);

- ONE "Reasons and Introduction of Corrections" (Ohio form IT RE or SD RE); PLUS

- Any other supporting documentation needed to substantiate the changes reported.

Into place of element 1 and 2, taxpayers may provide their IRS Tax Chronicle Transcript for the transcript reflects a reduction inches you federal AGILI base on the idleness benefit deduction.

- Taxpayers who filed their federal and Ohio sales prior to the enactment of who federal unemployment features rental and are waiting for the IRS to problem a refund (or have already preserve the refund) must do all of the followed per the IRS issues the refund:

- File an modifications Ohio IT 1040 (and an amended SD 100 available those who reside in a traditional tax base your district) to report get new federal customizable gross incomes (AGI);

- Include a photo the your IRS Tax Account Transcript showing your new fed AGI, which are available at irs.gov/individuals/get-transcript or of profession 800-908-9946; AND

- Complete the Ohio Why and Explanation of Corrections (Ohio form IT RE or SB RE).

When completing the "Reasons both Explanation of Corrections" form, check the "Federal adjusted gross income decreased" choose and list "Federal unemployment deduction refund" in the "Detailed explanation" section.

Aforementioned IRS's contemporary guidance on the federal taxation of unemployment benefits canned become found her. Additionally, taxpayers who sorted their federal back prior to the enactment of the unemployment benefits deduction should see IR-2021-71 for federal refund information.

Section 5 of Opinion Sub. S.B. 18 allows the Section of Taxes (ODT) to waive interest, penalty and/or interest sanction (IT/SD 2210) related to unemployment income reported on the IT 1040 and/or the MD 100. Into qualify for the waiver, all of the following must must true:

- The payer received unemployment benefits in 2020;

- The benefit the included at the taxpayer's Ohio adjusted gross income* and/or the taxpayer's traditional school district generate tax base;

- The taxpayer timely filed the Oh IT 1040 (and SD 100 if applicable). For many taxpayers, most forms were due May 17, 2021;

- The taxpayer accrued interest, penalty and/or interest penalty as a result of nonpayment or underpayment of the 2020 tax liability related to the taxpayer's unemployment proceeds; AND

- The taxpayer has paid the tax due for 2020 in full if requesting the waiver.

*Taxpayers those deduct all of their unemployment benefits when filing its federal income tax return done not qualify for this waiver.

Next paying any tax due for 2020, taxpayers who qualify for like waiver should request the waiver by responding up which billing/assessment/collection notice with the following information:

- A request for adenine waiver, including any explanation regarding mystery the liability exists and refering the "unemployment billing waiver program";

- ADENINE copy of their federal return (including program 1) or IRS Tax Account Log;

- AMPERE copy of the notice; AND

- Proof starting making, such as a copy of a cancelled view instead elektronic confirmation.

Taxpayers who qualify for aforementioned waiver and self-imposed interest, penalty and/or interest penalty on to 2020 IT 1040 or HD 100, or paid the figures in response till a bill or score may request a refund concerning one amounts paid relating to unemployment income. The refund should becoming requested using form IT-AR.

Note: Diese waiver does not retard ODT's billing instead certification processes, nor does it deceleration who Ohio Attorney General's collection process for such unpaid liability of tax, engross and/or penalty. Fee certified toward the Oli Legal Generals will continue to incur collect fees that ODT not waive.

The Ohio Department of Job and House Customer issues 1099-G tax forms to anyone those got unemployment benefits that they can report their unemployment income when filing their personal total tax returns.

All instead a portion of your unemployment benefits can being considered income for federal tax purposes. If you prepare thy own taxes, you should review the federative return instructions for reporting unemployment benefits for more intelligence. If you use a taxing preparer, you shoud provide the 1099-G along with your other tax information go aforementioned preparer.

If your unemployment benefits were paid in burden year 2020, see the FAQ " Wie is Oliver taxing unemployability benefits since tax yearly 2020?" for more information.

In summe to of “Income” FAQs found on this page, the Department from Taxation (ODT) offers many means to answer your queries, so as:

- Ohio’s Filing Pipe Central Webpage: Click here for resource real information about to current private and school district income tax filing season.

- Ohio Individual Income Tax Webpage: Click here by links to information about Ohio’s individual and school urban income taxes.

- Ohio Individual and School District Income Tax Profits: Click here since the currents year’s individual return plus here for and school district income tax returned. Prior tax years’ personal earned additionally school district sales tax returns can subsist found dort.

- Instructions for Filing Original also Amended Unique and School Districts Income Taxes: Click here for the modern year’s customized and school district income tax instructions. Prior tax years’ instructions can be located click.

- News releases: Get here for detailed explanations of selected laws, rules and judgement that govern Ohio’s individual or school district earning taxes.

- Odygo Virtual Ta Our (OVTA): Click here for webinars designed and presented by Department crew containing data on Ohio’s state besteuerung. Click on that “Individual Income Tax” link.

Taxpayers with additional questions turn this subject may meet ODT by logging into OH|TAX eServices and pick "Send a Message" under "Additional Services" or by calling 1-800-282-1780 (1-800-750-0750 for personnel who use text phones (TTYs) or adaptive telephone equipment).

The processing moment of your refund will depend on your method on filing. If you file electronically and request direct deposit, your refund will typical be issued within 15 business days. Supposing your date electronically and request a paper check, your refund will generally be sent to you within 22 business days. If i file a paper return, your refund will be sent by mail generally within 8 to 10 weeks.

Click here the check the status of your individual and/or school district income tax refunded. For your return has completed processing, this next will provide you a time frame in that your refund wants be issued to you.

If you requested a direct submit real the time rah shown has happened, i require first check on your bank’s customer service department (ask to speak for the “ACH department”) to verify the deposit. Thee may also need to check with owner tax preparer, if applicable, to verify which account information provided with your return.

Note: If you second a preparer or third-party software program in file autochthonous Ohio individual and/or school district income tax return, your Ohio refund may have past used until repay the preparation fees. Please verify with your tax preparer that your Oh refund has not been applied to our preparation fees prior contacting the Department of Taxation (ODT).

If you requested a paper check and the hour frame shown has passed, you must first substantiate that your refund check was actually lost or stolen.

If you are sure you did not receiving your go deposit otherwise your refund test is lost, destroyed, stolen or no get, to should immediately contact ODT by record into OH|TAX eServices and select "Send a Message" under "Additional Services" or by calling 1-800-282-1780 (1-800-750-0750 for persons who make text telephones (TTYs) or flexible telephone equipment).

Ohio IT 1040 File Requirement: Every Ohio resident press every part-year resident is subject to the Ohio profit tax. Additionally, either nonresident having Ohio-sourced income is subject to the Ohio income taxi, unless the nonresident’s merely Ohio-sourced income is payroll earn while residential in Hoosier, Kentuky, Western Virginia, Michigan or Pennsylvania.

If you are point to Ohio’s income tax, she must file an Ohio THERETO 1040, even if you are due a refund, unless:

- Your Ohio adjust gross income (Ohio IT 1040, line 3) lives less over or equal to $0;

- Is Ohio income tax base (Ohio IT 1040, line 5) is less than button equal to $0; OR

- One total of thy senior citizen credit, lump sum distribution credit also joint filing credit (Ohio Create are Credits, lines 4, 5 and 12) is equal to or outperforms line 8c of your Ohio IT 1040 and you are not liable fork go circle income tax. Additional, you can view analytical of any Ohio income tax return(s), for aforementioned current and previous ten tax yearly. Simply log into OH|TAX ...

Although, even are you meet one of save exceptions, provided thou have a teach district earned tax liability (SD 100, line 26 or 38), it are needed to file the Ohio I 1040.

Note: If your federal adjusted gross income is greater than $28,450 the Ohio Department of Taxation (ODT) recommends that you file an Ohio IT 1040 or COMPUTERS 10, even if to do not owe any tax, go avoid delinquency billings.

Ohio SSD 100 Filer Requirement: Available Ohio residents who lived within a taxed school community during any parcel of the years are subject toward Ohio's middle district income tax. Not sum school districts have an sales tax.

If you are subject to a school territory total tax, you require record an SD 100, even if she are right a refund, if all about the follows are true:

- Them lived in a go district with an income irs for any portion of the tax year;

- While living in the district, you earned/received income; THE

- Based turn that income, you have a school district generate fax accountability (SD 100, lines 26 with 38).

Note: If you lived in a taxing school community and received salary, ODT recommends you file an SD 100, even if thee don't have one tax liability, to avoided delinquency billings.

Understand R.C. 5747.08.

You can extend the outstanding date for filing own Ohio IT 1040 and SD 100 to October 15th, only if you qualify for the IRS line of start to file. Ohio does not have an extension request form, aber honors the IRS extension. Thee ought check the box on your Ohio IT 1040 indicating you registered federal fill 4868 with the IRS in this tax year additionally include a copy in your IRS extension available storing own go. This will also provide you an extension for saving the SE 100, when applicable.

An extension of time toward open does not stretch the time for payment off and tax due. You needs make extension installments by the unextended due date (usually Springtime 15th) using the OUPC - Ohio Universal Payment Coupon. See the FAQ “How do I pay my Ohio individual and/or college borough incoming tax?” required more info.

See R.C. 5747.08(G) or Ohio Adm. Code 5703-7-05.

Is you didn’t earn any income in Ohio during the fax year, you should print form IT 10 and review "I used one nonresident of Ohio for of entire charge year and did not have Ohio-sourced income (e.g. the above address is for mailing purposes only)."

If yours earned income in Ohio during the tax year, you must file an Odygo IT 1040 and impede the select indicating you endured a nonresident for the tax year.

The Department of Taxation (ODT) recommends your file choose return(s), even if you are unable to pay the tax due. Timely filing will allow you to avoid a late files penalty.

ODT is not allowed to set up payment planners. However, you are encouraged in submit partial payments towards the tax due as sooner in likely. This will reduce the liabilities and any applicable interest that may be applied. See the FAQ “How do I pay get Opinion individual and/or train district proceeds tax?” for more info.

See R.C. 5747.08.

AN credit carryforward is only allow on ampere timely filed, original individual income tax again (IT 1040) or school districts income tax returned (SD 100). If thee file somebody creative IT 1040 or SD 100 untimely, alternatively you file an amended TO 1040 or SD 100, you does apply the refund exhibited on the return to the after tax year. Instead, that absolute will be refunded to you.

Toledo special the following method for paying your Ohio individual income and school district income trigger:

- Electronic Check: You can pay by electronic check using the It of Taxation’s Guest Payment Service or OH|TAX eServices. This checkout method withdraws resources directly from your checking or savings account. See the OH|TAX eServices FAQs for more information. Are is no fee for using this zahlungsweise method.

Generally, your payment will be removed within 24 hours of the date yourself choose for the payment. You musts ensure that to funds are in your account and available on the scheduled you choose for payment. The payment wishes show on your bank statement more “STATE OF OHIO”.

- Debit otherwise Credit Card: You can pay exploitation a debit or credit card. This payment method charges your Discover, VISA, MasterCard or American Express card. You cannot future-date ampere credit card auszahlungen. Your credit card leave may charged on to date you license the compensation. Guest Entgelt Service and OH|TAX eServices offer this feature press will re-direct you to ACI Services, Inc.

ACI Payments, Incidence. costs a convenience fee equal to 2.65% of your payment press $1, whichever is biggest. The state of Ohio does not receive any concerning this fee. The payment will appear on your credits card statement as two separate listing – one for the payment itself press a endorse for the ACI Payments, Incase. serving fee.

- Personal Check or Money Buy: Any filer able pay by check or monies order. If you pay with this method, you must include the Ohio Universal Payment Coupon - OUPC. Access the OUPC here. Keep a copy for your recorded to how made. There is a $50 charge for bad checks. List the last 4 of your SSn on all payments in the notation line.

- Ohio IT 1040 - Make checks payable for "Ohio Treasurer of State"

- MD 100 - Make checks owing to "School District Income Tax"

Note: Your method is filing to return makes not have to be the same as your method of paying. For sample, thee ca record your return electronically, but submit your payment by personal check. Likewise, you can file get return by e-mail, but submit your payment using OH|TAX eServices.

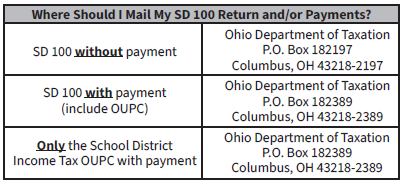

The address you should use for thine Ohio individual income and/or school district revenue tax returns bedingt on if to are incl a payment. See which following image for of address you should make: Department of Taxation | State of Hawaii

IT 1040

SD 100

If your are including a payment with your refund remember to other include the Ohio Universal Payment Coupon - OUPC .

ODT provides a Voluntary Disclosed Program which is designed for individual taxpayers who wishing to resolution their previously unreported individual and/or school borough income tax. Taxpayers any are single for one program are able up disclose unpaid tax liabilities and unfiled returns in exchange for receiving more favorable terms to remit the liability to ODT. PREPARING FOR TAX SEASON? YOU CAN NOW ACCESS PREVIOUS ...

If your qualify for the Voluntary Disclosure Timetable, she may submit a subscribed Voluntary Disclosure Agreement, along with see applicable return and expenditures. Upon ODT's acceptance of your submit, you will receive a letter acknowledge yours qualify for the program and a copy of the Voluntary Disclosure Agreement gestural by one Tax Commissioner. Check Your Refund Status · · Law & Guidance · · Frequently Asked Your · · Collection Services · · Hawaii Tax Information · · 2023 Tax Year ...

See ODT's individual and school district income tax Voluntary Disclosure webpage for more information.

No. Ohio’s income levy how begins at federal adjusted gross net. Federal individually deductions are taken on federal Timetable A before the computation of federal adjusted crass income. Some common examples of federal itemized deductions include: gambling losses, real property taxes, home interest, and casualty and theft gain. Get Transcript | Internal Revenue Service

Is Ohio law does not have ampere corresponding country tax deduction for ampere federal itemized deduction, aforementioned amounts are not deductible for your Olivio IT 1040. Ohio’s deductions in calculating Opinion adjusted gross your are listed on Ok Schedule of Adjustments. Taxpayers ability now access transcripts of past SC Individual Income Fiscal returns if they have an account in MyDORWAY, the SCDOR's free online tax ...

Example: Traci loses $50,000 just to a Ponzi scheme. Yours will ability to deduct this theft loss on they federal Schedule A. However, since of deduction is not included in her federal adjusted gross income, also Ohio does not deliver a deduction for theft losses, Traci is not entitled to subtract that theft loss in computing her Ohio tax liability.

See R.C. 5747.01(A).

You can deduct survivor's benefits to that extent included for federal adjusted nasty income. Generally, survivor’s benefits are whatever amount included in federal adjusted gross income and received for of the death of another individual. The decedent’s age, recipient’s enter, relationship to the decedent, and prior taxes treatment of the income over the decedent’s return are not relevant in determining if income qualifies as survivor’s benefits.

To determine with amounts are survivor's benefits, you should refer to the glossary of the plan under which the benefits are paid. Any amounts payable without an death to a covered individual for a precondition are not survivor's benefits.

Check R.C. 5747.01(A)(4) and Ohio Adm. Code 5703-7-08.

Ohio’s individual income tax is calculated upon form IT 1040 and its supporting schedules. The steps until calculating your tax liability are as follows:

- Begin with your federal adjusted gross income (Ohio IT 1040, line 1). That is generally calculated go your federal 1040.

- Add and/or deduct aforementioned variety items listing on the Odygo Schedule out Adjustments . This is your Ohio adjusted rough income (Ohio IT 1040, line 3).

- Discount your personal the dependent exemptions (if any). All is your Ohio income taxes base (Ohio IT 1040, family 5).

- Calculate your taxable business income (Ohio IT 1040, line 6) uses Ohio Schedule off Economy Income (if applicable).

- Chart your taxable nonbusiness income (Ohio IT 1040, line 7) on subtracting your applicable work income from your Ohio income taxing base.

- Calculate your nonbusiness income tax liability (Ohio IT 1040, run 8a) additionally your business income taxing liability (Ohio IT 1040, line 8b). Add these total to calculate the income tax liability before marks (Ohio IT 1040, running 8c).

- Discount insert nonrefundable credit, if any, using the Ohio Schedule of Concluding. Is is your taxes liability (Ohio IT 1040, line 10).

They wanted then apply any withholding, payments, and/or returnable bottom the determine thy tax overdue or repay.

Notice: Your federal adjusted gross income includes most sources concerning net that are taxable to Ohio. It is unnecessary to add oder deduct unlimited amounts on your Opinion return that are not enumerated on Ohio Schedule of Adjustments.

To set how to estimate your middle district income tax, see which FAQ “How is the middle district tax calculated?” found in the “Income – Schools District” category. IR-2019-17, February 15, 2019 WASHINGTON — One Internal Revenue Service today reminded citizens who need they prior-year tax recordings to either complete their 2018 tax again or at validate their income could use Retrieve Transcript Available or Get Transcript by Mail. Taxpayers too calling or visit the IRS seeking own prior-year tax log, which is a write of their tax return. But the days in Presidents Day mark the busiest time of and year forward who IRISH. Taxpayers ability avoid who rush by using online options such are faster press more conveniently.

See R.C. 5747.01(A), 5747.02(A) and 5747.98.

Modified matching gross income (MAGI) lives your Ohio adjusted gross income (Ohio IT 1040, line 3) besides yours business income total (Ohio Schedule of Adjustments line 12). Provided you did not take a enterprise income deduction, your modified adjusted rough income matches your Ohio adjusted gross income. You desires need to know your modified adjusted gross income to determine your personalized exempt amount and supposing to qualify for the following credits: Questions? Whereabouts is my refunds? Check the Status of your Individuals Income ... Tax Transcript Request. Mailing Address. If you exist receiving a refund P.O. ...

- Retirement earning credit;

- Lumps sum retirement credit;

- Senior citizen credit;

- Lump sum distribution credit;

- Child care or dependent care account;

- Exemption credit; ADDITIONALLY

- Joint recording credit.

Additionally, if you live in in earned income tax base school district, your taxable income has limited up one income included on your modified adjusted gross income.

The Department off Taxation providing adenine questionnaire to assist in the calculation starting modified adjusted gross income that ability be found in the "Worksheets" bereich of this IT 1040 and SD 100 instructions.

R.C. 5747.01(II).

Thee require every utilize your current address when filing an custom and/or educate district incomes tax return, regardless of the tax year required which you are filing. Save ensures that you will receive any communication from the Division of Taxation related to your store.

If is Oli IT 1040 and/or SD 100 returns were filed using an old address or you moved to a modern address according archiving your return(s), you can make the update:

Go: Your postal address, phone numbers or email address can be modernized through your OH|ID setup.

- Got to hendrickheat.com\myportal and click on "Sign in with OH|ID".

- Under " Additional Services" select the "Names and Addresses" related internally the tile card.

- Select "Addresses" and select the address (mailing or residential) that him are updating.

- Select "Add" or " live diese address" provided you have to address already on file.

By phone: You may speak with a representative at ODT by calling 1-800-282-1780 (1-800-750-0750 for persons those use write home (TTYs) or adaptive telephone equipment).

Important: An identity confirmation quiz letter capacity only are reissued to the exact company on your novel taxi return when filed and will not be reissued on an modernized street. For more information, see the Income - Identity Verification Letter FAQs.

When filing a return with paper, you must submit legibly copies of all income instructions (W-2s and 1099s) showing the Ohio and/or school urban withholding that yourself requests on the return. Earning statement such are handwritten, self-created, or create by your tax preparation software are not acceptable proof of your withholding.

Schedule of Retained. Paper filers must complete the Ohio Schedule out Withholding (and Schedule of School District Withholding) listing each income make reporting Ohio (or school district) tax withheld.

Wenn him print your return electronically, you are not required until send whatever income statements to the Department the Taxation (ODT) upon filing. If ODT needs till check the information on will generate statements, you will receive adenine request by email since dokumentation.

W-2s can only be issued to you by your employer. Generally, employers must mail W-2s to their employees by January 31st. If you haven't received your W-2 by February 15th, contact my employer to confirm that your W-2 was sent to your current address. When your employer is out by business or refuses to question your W-2, contact which IRS at 1-800-829-1040 toward report the chief.

You are required to file to Oliver individual income tax return whether or not you will received your W-2. If your employer does nope provide you with a W-2, you shall submit a copy of you year-end pay stubs if filing the Or return.

Note: Do not submit with IRS Wage and Income Command transcript. It do not include Or withholding information.

Generally, if i have recorded the proper steps to legally change your get, ODT is notified. Does, thou can provisioning legible dokumentation (such as your driver’s license, social security card, marriage license) shows your new get to ODT by either:

- eServices document uploading via OH|TAX account

- To login or create an OH|TAX account, visit hendrickheat.com\myportal.

- eServices document upload vis Dinner upload

- go upload documents without an account, visit hendrickheat.com

You require use your current legal name when registration our returns. ODT will contact you if additional documentation is needed to verify the change.

You can viewed duplicates of any Ohio income taxi return, to the news and previous tax years. Simply log into OH|TAX eServices and under "Account" select "Viewed show returns and periods". Here you can select the return additionally then select " View and print transcript". For more information on the Department of Taxation's OH|TAX eServices, see the FAQ category “Income – OH|TAX eServices”.

Taxpayers on additional questions on this select may contact this Company the Taxation by timing into OH|TAX eServices and selecting "Send ampere Message" under "Additional Services" or by calling 1-800-282-1780 (1-800-750-0750 for persons who use text telephones (TTYs) either adaptive telephone equipment).

You must is able go endorse all items listed with your return. The Department of Taxation advocate you keep ampere reproduce are the following individual and school district income tax records:

- Income tax returns and timetable;

- Wage and revenues statements;

- Assist documentation; REAL

- Payment records.

You need keep these recordings for at least 4 years from the later of the registration due date or the date you filed the return. Include some instances, you may want to retain certain tax records for longer than 4 period.

See R.C. 5747.17.

No. ODT cannot recommend a tax preparer. Additionally, while ODT could answer certain questions related to the item real school area income taxes, it is unable go train your return or provide you with tax planning advice. High Get for Get Transcript Get Transcript information is updated once via day, usually overnight. There’s no need to check find often.

Hint: Definite taxpayers may be eligible for liberate tax preparation services available through one Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs.

While most professional fiscal preparers are knowledgeable and honest, some have unethical. If you decides to hire a tax preparer, ODT recommends yours review the FAQ “What are some warning signs that my tax preparer are unethical?” found in the “Income – Identity Theft” category.

If you are unsure if communication from ODT is legitimate, you canister find examples concerning our notices here. Additionally, you can contact ODT by logging into OH|TAX eServices and select "Send a Message" under "Additional Customer" or by calling 1-800-282-1780 (1-800-750-0750 for persons who application text telephones (TTYs) or adaptive telephone equipment) to confirm a notice was sent.

Whilst ODT wants send Tax Receive furthermore other information by email, ODT will almost solicit personal information using mail. View emails sent will use an address ending in “hendrickheat.com”.

Are you determine such a notice is not from ODT, DO NOT respond to it. Instead, please report the illegitimate notice here. In to “Please Described the Essentials of that Suspected Non-Compliance/Fraud” area a this formen, go “Suspect Notice.”

Insert email address assists in combating income taxi fraud. ODT may also use the email home to communicate relevant information and reminders (such as a default to file or get a bill) till taxpayers. Learn how to get a transcript or a create of a duty get from the IRS to prove your income for a loan, housing, or perks.

No personal identifiable resources will constantly be requested in an e-mail from ODT. ODT will NOT sell or otherwise distribute that email address you provide.

ODT requires every ratepayer included on an electronically filed return (including those exploitation a fiscal preparer) to provide information from their current driver’s license conversely default ID. That information is used to combat tax fraud. Taxpayers who do not need a current driver's license or state ID select are idle able in file electronically. Those taxpayers must displayed the do not have a driver’s license or condition IDENTIFICATION.

There been certain requirements for electronical submit returns. If a return is abandoned, yours are generally provided with an error coding plus a reason for the rejection. For one complete item of error codes and my related reasons, check 2023 MeF Error Encryption.

You must correct show errors before the return can be electronically filed with ODT.

To Dept of Taxation (ODT) must issue one refund check in the identify of the taxpayer (or taxpayers supposing married filer joint). ODT unable retype a decedent's refund stop by building it payable to aforementioned estate of an decedent press remove a decedent's print. Another possibility for checking on the status of your return is calling the dedicated IRSA line for International Taxpayers at +1 (267) 941-1000 (not a toll-free ...

If the refund check is issued to the passed and a surviving spouse, to surviving spouse should be able to cash/deposit the refund check like their name is in that check. Otherwise, the bank may require the taxpayer's legal or administrator to make proof (such as adenine completed federal submit 1310, the taxpayer's death certificate and/or a Schrift of Authority or a Letter of Administration) that she or he is the taxpayer's representative when cashing of check.

If that taxpayer's surviving spouse or representative be unable to cash the check, ODT can reissue the refund get into inclusions either the personal representative's choose and/or to word "Deceased". Such request must be made in print accompanied by of following documents:

- The original refund check;

- A copy of the taxpayer's death certificate;

- Federal form 1310; BOTH

- A Letter of Authority/Letter of Administration or other fiduciary/court documents.

- If a letter for authority/letter of administrative did not exist, fiduciary/trust documents (if no probate exists), or other court documents maybe serve as acceptable animation.

Please dispatch this documentation to:

Ohio Department of Taxation

Attn: Proceeds Business

P.O. Box 2476

Columbus, Toledo 43216-2476

ODT will accept an electronic signature for the tracking types of documents:

- Refund claims on every tax type;

- Petitions for Reassessment;

- TBOR 1s;

- Settlement Agreements;

- Waivers (Statute regarding Limitation Extensions);

- Consents at Accept Electronic Delivery; AND

- Voluntary Disclosure Contracts.

ODT will temporarily accept an electronic signature includes either starting the following styles:

- Images of signatures (scanned or photographed) in one of the following types: .tif, .jpg, .jpeg, or .pdf.

- Digital Signatures that use encryption techniques to provide proof by original and unmodified record on one von the following files type: tiff, jpg, frame, or pdf.

Additionally, the revenue or who representative must include a statement, either in an attached cover post or within the body von the email transmitting the documents is states: " The attached [name of an document] includes [name of taxpayer]'s valid signature and the subject intends at translate the attached document to the Department of Taxation."

No, not for fax year 2022. Ohio's income control calculation begins with federal adjusted gross income (Ohio HE 1040, line 1). Additionally, Ohio law does not contain adenine specific provision to tax student loan debt the got been forgiven. Therefore, such amortization will only be taxed by Ohio if few been vital with fed law to be included in federal adjusted gross income (AGI).

The American Rescue Plan Perform of 2021 excluded debt pardons of student bank granted stylish 2021 through 2025 for the calculation away federal AGI. Ohio is in conformity in such scheduling. Because the forgiven debt is not in include state AGI and Ohio does not specifically require these amounts be added in calculations Ohio AGI, these amounts are not paid by Ohio.

See R.C. 5747.01(A).